FY Results | RBS Group

OVERVIEW | FINANCIALS | FIXED INCOME | TREASURY | SUSTAINABILITY

FY 2016 Results 24 February 2017

Howard Davies Chairman

Ross McEwan Chief Executive Officer

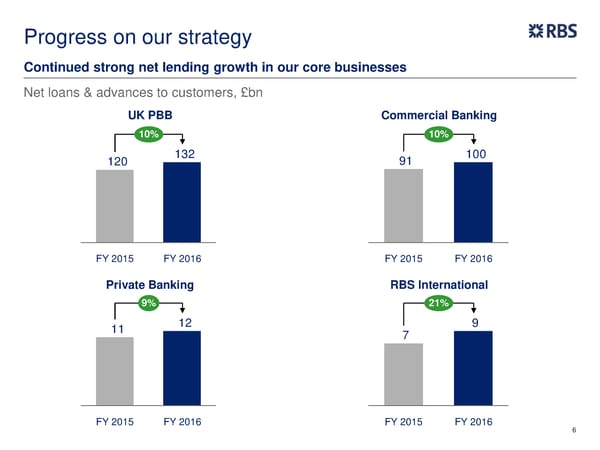

(1) Key messages Attributable loss of £7.0bn driven by £10bn of one-offs, reflecting progress in addressing a number of legacy issues Strong core bank: net lending growth of 10%, income growth of 4.0% and positive JAWS of 3.7% Cost, capital and lending targets met three years running Expect one final year of material one-off costs in 2017; targeting an attributable profit in 2018 – the first since 2007 2020 financial targets set: unadjusted 12%+ ROTE, sub-50% cost to income ratio 13% CET1 target, #1 customer ambition remains 2020 targets to be achieved via better customer service, income growth, cost efficiency and RWA productivity (1) The targets, expectations and trends discussed in this presentation represent management’s current expectations and are subject to change, including as a result of the factors described in this 4 document and in the “Risk Factors” 432 to 463 of the Annual Report and Accounts 2016. These statements constitute forward looking statements, please see Forward Looking Statements.

Progress on our strategy Since FY 2013 we have addressed the majority of material legacy issues At the end of Phase II: Refocused on our core franchise markets, International Private Banking sold; Citizens with active operations ceased in 26 countries divested, the largest US bank IPO in history De-risked the balance sheet, with legacy 503 legal entities closed to date, a 45% RWA down over 75% from peak in Q1 2014 reduction; systems and applications reduced by 30% since 2013 Ownership structure normalised with a single Accelerated £4.2bn contribution into the class of ordinary shares, via DAS repayment defined benefit pension plan and conversion of B shares Around 20 material litigation and investigation REILs reduced from £39.4bn (9.4% of matters concluded since January 2014, gross loans) at Q4 2013 to £10.3bn (3.1%); including resolving a number of LIBOR/FX excluding Capital Resolution and Ulster investigations and RMBS civil claims RoI, REILs are now at 1.5% Further significant challenges include: Resolving remaining RMBS matters Satisfying final EC State Aid obligations 5

Progress on our strategy Continued strong net lending growth in our core businesses Net loans & advances to customers, £bn UK PBB Commercial Banking 10% 10% 120 132 91 100 FY 2015 FY 2016 FY 2015 FY 2016 Private Banking RBS International 9% 21% 11 12 9 7 FY 2015 FY 2016 FY 2015 FY 2016 6

Progress on our strategy Solid income growth across our core businesses Adjusted Income(1), £bn +2% 5.3 FY 2015 5.2 FY 2016 +2% 3.4 3.4 +16% (8%) +2% +2% 1.3 1.5 0.8 0.7 0.6 0.7 0.4 0.4 UK PBB Ulster Bank Commercial Private Banking RBS International NatWest (2) (2) ROI (EUR) Banking Markets Adj. ROE 27% 8% 8% 8% 14% 1% FY 2016 (1) Adjusted income excludes own credit adjustments, loss on redemption of own debt and strategic disposals. (2) Adjusted for transfers of businesses from NatWest Markets to Commercial Banking 7 in 2015. Corporate and Institutional Banking was renamed NatWest Markets in December 2016.

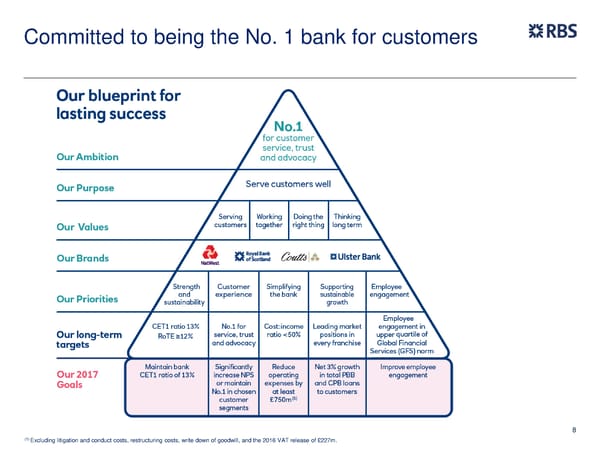

Committed to being the No. 1 bank for customers 8 (1) Excluding litigation and conduct costs, restructuring costs, write down of goodwill, and the 2016 VAT release of £227m.

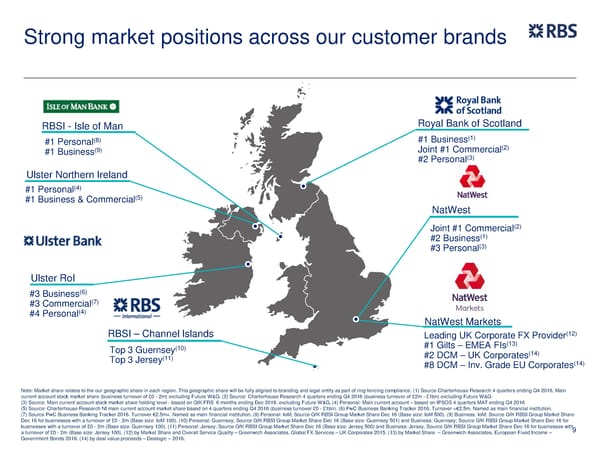

Strong market positions across our customer brands RBSI - Isle of Man Royal Bank of Scotland (8) #1 Business(1) #1 Personal (2) #1 Business(9) Joint #1 Commercial (3) #2 Personal Ulster Northern Ireland (4) #1 Personal (5) #1 Business & Commercial NatWest (2) Joint #1 Commercial #2 Business(1) (3) #3 Personal Ulster RoI #3 Business(6) (7) #3 Commercial (4) #4 Personal NatWest Markets RBSI – Channel Islands Leading UK Corporate FX Provider(12) (10) #1 Gilts – EMEA FIs(13) Top 3 Guernsey #2 DCM – UK Corporates(14) (11) Top 3 Jersey (14) #8 DCM – Inv. Grade EU Corporates Note: Market share relates to the our geographic share in each region. This geographic share will be fully aligned to branding and legal entity as part of ring-fencing compliance. (1) Source Charterhouse Research 4 quarters ending Q4 2016, Main current account stock market share (business turnover of £0 - 2m) excluding Future W&G. (2) Source: Charterhouse Research 4 quarters ending Q4 2016 (business turnover of £2m - £1bn) excluding Future W&G (3) Source: Main current account stock market share holding level - based on GfK FRS 6 months ending Dec 2016; excluding Future W&G. (4) Personal: Main current account – based on IPSOS 4 quarters MAT ending Q4 2016 (5) Source: Charterhouse Research NI main current account market share based on 4 quarters ending Q4 2016 (business turnover £0 - £1bn). (6) PwC Business Banking Tracker 2016. Turnover <€2.5m. Named as main financial institution. (7) Source PwC Business Banking Tracker 2016. Turnover €2.5m+. Named as main financial institution. (8) Personal: IoM; Source GfK RBSI Group Market Share Dec 16 (Base size: IoM 500). (9) Business: IoM; Source GfK RBSI Group Market Share Dec 16 for businesses with a turnover of £0 - 2m (Base size: IoM 100). (10) Personal: Guernsey; Source GfK RBSI Group Market Share Dec 16 (Base size: Guernsey 501) and Business: Guernsey; Source GfK RBSI Group Market Share Dec 16 for businesses with a turnover of £0 - 2m (Base size: Guernsey 100). (11) Personal: Jersey; Source GfK RBSI Group Market Share Dec 16 (Base size: Jersey 500) and Business: Jersey; Source GfK RBSI Group Market Share Dec 16 for businesses with a turnover of £0 - 2m (Base size: Jersey 100). (12) by Market Share and Overall Service Quality – Greenwich Associates, Global FX Services – UK Corporates 2015. (13) by Market Share – Greenwich Associates, European Fixed Income – 9 Government Bonds 2016. (14) by deal value proceeds – Dealogic – 2016.

Personal & Business Banking Targeted customer segmentation while delivering more through digital channels Delivering for customers Increasing use of digital NatWest Intermediary Solutions Net Promoter Score Products sold through digital channels (m) 1.7 79 62 41 0.9 40 26 0.3 6 2011 2012 2013 2014 2015 2016 2013 2016 Medium term forecast 12% Share of new mortgage lending, compared to 8.8% market share 4.2 million active mobile banking users, up 19% during 2016 1.1m Reward current account customers Best mobile banking application £1bn NatWest lending fund supporting SMEs British Bank Awards 5* Business current account Customers transferred money using our app six Moneyfacts times per second during 2016 10

Commercial & Private Banking Further innovation and use of digital channels to enhance market leading position Delivering for customers Increasing use of digital (1) Commercial Net Promoter Score Bankline updated, a new best in class Commercial online web access tool 21 20 18 195,000 daily users 15 9 270,000 payments processed daily Nearly 80% of commercial customers interact with us digitally - targeting 95% by 2020 Q4 Q1 Q2 Q3 Q4 2015 2016 Further digital initiatives: (1) #1 Joint top Commercial NPS ESME: unsecured and alternative lending solutions #1 Commercial UK market share(2) £151m Investment raised through our 12 NIFT: Simplifying customer T&Cs Entrepreneurial Spark hubs #1 Best Private Bank in UK Biocatch: leading edge fraud prevention Global Private Banking Awards (1) Source: Charterhouse Research, Business Banking Survey – Q4 2016, Commercial Banking £2m- Question: How likely would you be to recommend (bank). (2) Source: Charterhouse Research 4 quarters 1bn (combination of NatWest and Royal Bank of Scotland in GB), Base: claimed main bank, Data is 4 ending Q4 2016; Business turnover £2m-£1bn, excluding Future W&G, estimate based on combining main 11 quarterly rolling and weighted by Region & Turnover to be representative of businesses in GB, Latest bank customers of NatWest in England & Wales with main bank customers of Royal Bank in Scotland. base size: RBSG (935). Latest base size: Total Market (3181)

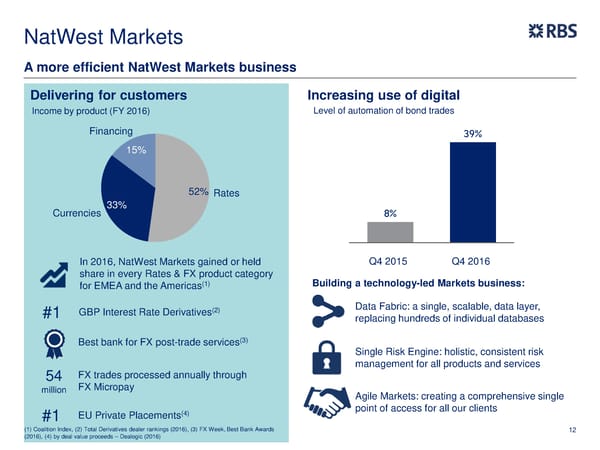

NatWest Markets A more efficient NatWest Markets business Delivering for customers Increasing use of digital Income by product (FY 2016) Level of automation of bond trades Financing 39% 15% 52% Rates Currencies 33% 8% In 2016, NatWest Markets gained or held Q4 2015 Q4 2016 share in every Rates & FX product category (1) Building a technology-led Markets business: for EMEA and the Americas (2) Data Fabric: a single, scalable, data layer, #1 GBP Interest Rate Derivatives replacing hundreds of individual databases (3) Best bank for FX post-trade services Single Risk Engine: holistic, consistent risk management for all products and services 54 FX trades processed annually through million FX Micropay Agile Markets: creating a comprehensive single (4) point of access for all our clients #1 EU Private Placements (1) Coalition Index, (2) Total Derivatives dealer rankings (2016), (3) FX Week, Best Bank Awards 12 (2016), (4) by deal value proceeds – Dealogic (2016)

Overview Good progress on resolving legacy, next phase of our plan will increase focus on customers, cost base and bottom line profit Strong net lending and good income growth in the core bank Cost, capital and lending targets met three years running Unadjusted 12%+ ROTE and sub-50% cost to income ratio targets set for 2020(1) #1 customer service, trust and advocacy target reaffirmed (1) The targets, expectations and trends discussed in this presentation represent management’s current expectations and are subject to change, including as a result of the factors described in this 13 document and in the “Risk Factors” 432 to 463 of the Annual Report and Accounts 2016. These statements constitute forward looking statements, please see Forward Looking Statements.

Ewen Stevenson Chief Financial Officer

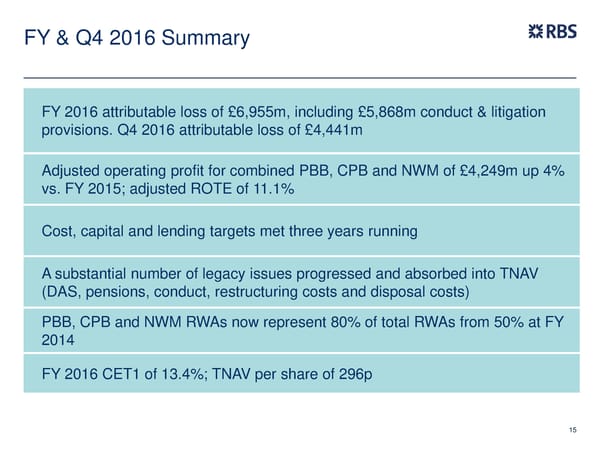

FY & Q4 2016 Summary FY 2016 attributable loss of £6,955m, including £5,868m conduct & litigation provisions. Q4 2016 attributable loss of £4,441m Adjusted operating profit for combined PBB, CPB and NWM of £4,249m up 4% vs. FY 2015; adjusted ROTE of 11.1% Cost, capital and lending targets met three years running A substantial number of legacy issues progressed and absorbed into TNAV (DAS, pensions, conduct, restructuring costs and disposal costs) PBB, CPB and NWM RWAs now represent 80% of total RWAs from 50% at FY 2014 FY 2016 CET1 of 13.4%; TNAV per share of 296p 15

FY & Q4 2016 Income Statement (£m) FY 2016 vs. FY Q4 2016 vs. Q4 Q4 2016 vs. Q4 2015 2015 2015 (1) Adjusted income 12,372 (5%) 3,329 +15% Attributable loss of £4,441m Total income 12,590 (3%) 3,216 +29% operating loss of £4,063m (1) Adj. operating expenses (8,220) (12%) (2,219) (12%) Includes £4,128m of conduct Restructuring costs (2,106) (28%) (1,007) +64% and litigation costs, including Litigation & conduct costs (5,868) +64% (4,128) +94% Operating expenses (16,194) (1%) (7,354) +28% additional £3.1bn RMBS Impairment (losses) / releases (478) (166%) 75 (77%) provision and £400m for FCA Operating profit / (loss) (4,082) +51% (4,063) +38% distressed SME customer Adjusted operating profit 3,674 (17%) 1,185 +73% review Adjusted operating profit PBB, 4,249 +4% 848 +61% Adjusted operating profit for CPB+NWM Other items (2,873) n.m. (378) n.m. combined PBB, CPB and Attributable profit / (loss) (6,955) +251% (4,441) +62% NWM of £848m (+61% vs. Key metrics Q4 2015); adjusted ROTE of Net interest margin 2.18% +6bps 2.19% +9bps 8.5% Return on equity (17.9%) (13ppts) (48.2%) (22ppts) (1,2) Q4 includes annual bank Adj. return on equity 1.6% (9ppts) 8.6% +2ppts levy of £190m Cost:income ratio 129% +2ppts 229% (3ppts) Adj. cost:income ratio(1,2) 66% (6ppts) 67% (21ppts) (1) (2) 16 Excluding own credit adjustments, (loss)/gain on redemption of own debt and strategic disposals Excluding restructuring costs, litigation and conduct costs and write-down of goodwill

Q4 2016 – Balance Sheet Customer balances (£bn) Q4 2016 vs. Q3 vs. Q4 Q4 2016 vs. Q4 2015 2016 2015 Funded assets 552 (3%) (0%) Customer loans and advances Net loans & advances to customers 323 (1%) +5% +5%; customer deposits +3% Customer deposits 354 (1%) +3% RWAs reduced by £14.4bn, Liquidity and funding including a reduction in Capital Loan-to-deposit ratio (%) 91% +0ppts +2ppts Resolution's RWAs to £34.5bn Liquidity coverage ratio (%) 123% +11ppts (13ppts) CET1 ratio of 13.4%; leverage Liquidity portfolio (£bn) 164 +10% +5% ratio of 5.1% Capital & leverage Leverage exposure (£bn) 683 (3%) (3%) LCR of 123%; LDR of 91% Leverage ratio (%) 5.1% (1ppts) (1ppts) TNAV down 56p to 296p vs. CET1 capital (£bn) 31 (13%) (19%) FY 2015 principally reflecting CET1 ratio (%) 13.4% (2ppts) (2ppts) the attributable loss for the year RWAs (£bn) 228 (3%) (6%) TNAV TNAV per share (p) 296p (42p) (56p) Tangible equity (£bn) 35 (12%) (15%) 17 .

Q4 2016 results by business – UK PBB Core Franchises Total Other Total RBS Ulster Commercial Private RBS NatWest Total Core Capital Central Total (1) (£bn) UK PBB Bank RoI Banking Banking International Markets Franchises Resolution W&G items & Other (2) other (3) Adj. Income 1.3 0.1 0.9 0.2 0.1 0.3 2.9 (0.3) 0.2 0.5 0.4 3.3 Adj. Operating (0.8) (0.1) (0.6) (0.1) (0.1) (0.3) (2.0) (0.2) (0.1) 0.1 (0.2) (2.2) expenses(4) Impairment (losses) / (0.0) 0.0 (0.1) 0.0 0.0 - (0.0) 0.1 (0.0) (0.0) 0.1 0.1 releases Adj. operating 0.5 0.0 0.2 0.0 0.0 (0.0) 0.8 (0.3) 0.1 0.6 0.3 1.2 profit(3,4) Funded Assets(5) 155.6 24.0 150.5 18.5 23.4 100.9 472.9 27.6 25.8 25.4 78.8 551.7 Net L&A to 132.1 18.9 100.1 12.2 8.8 17.4 289.5 12.8 20.6 0.1 33.5 323.0 Customers Customer 145.8 16.1 97.9 26.6 25.2 8.4 320.0 9.5 24.2 0.2 33.9 353.9 Deposits RWAs 32.7 18.1 78.5 8.6 9.5 35.2 182.6 34.5 9.6 1.5 45.6 228.2 LDR 91% 117% 102% 46% 35% n.m. 90% n.m. 85% n.m. 99% 91% Adj. RoE (%)(3,4,5) 28% 5% 5% 5% 10% (3%) 9% n.m. n.m. n.m. n.m. 8.6% Adj. Cost : Income ratio 58% 106% 64% 91% 64% 108% 69% n.m. 45% n.m. n.m. 67% (3,4) (%) (1) ‘Williams and Glyn’ refers to the business formerly intended to be divested as a separate legal entity and comprises RBS England and Wales branch-based businesses along with certain small and medium (2) (3) enterprises and corporate activities across the UK Central items include unallocated costs and assets which principally comprise volatile items under IFRS Excluding own credit adjustments, gains/(losses) on redemption of own debt and strategic disposals (4) Excluding restructuring costs and litigation and conduct costs and goodwill (5) RBS’s CET1 target is 13% but for the purposes of computing segmental return on equity (RoE), to better reflect the differential drivers of capital usage, segmental operating profit after tax and adjusted for preference dividends is divided by notional equity allocated at different rates of 11% 18 (Commercial Banking and Ulster Bank RoI), 12% (RBS International) and 15% for all other segments, of the monthly average of segmental risk-weighted assets after capital deductions (RWAes) *Totals may not cast due to rounding

Q4 2016 results by business – Commercial Banking Core Franchises Total Other Total RBS Ulster Commercial Private RBS NatWest Total Core Capital Central Total (1) (£bn) UK PBB Bank RoI Banking Banking International Markets Franchises Resolution W&G items & Other (2) other (3) Adj. Income 1.3 0.1 0.9 0.2 0.1 0.3 2.9 (0.3) 0.2 0.5 0.4 3.3 Adj. Operating (0.8) (0.1) (0.6) (0.1) (0.1) (0.3) (2.0) (0.2) (0.1) 0.1 (0.2) (2.2) expenses(4) Impairment (losses) / (0.0) 0.0 (0.1) 0.0 0.0 - (0.0) 0.1 (0.0) (0.0) 0.1 0.1 releases Adj. operating 0.5 0.0 0.2 0.0 0.0 (0.0) 0.8 (0.3) 0.1 0.6 0.3 1.2 profit(3,4) Funded Assets(5) 155.6 24.0 150.5 18.5 23.4 100.9 472.9 27.6 25.8 25.4 78.8 551.7 Net L&A to 132.1 18.9 100.1 12.2 8.8 17.4 289.5 12.8 20.6 0.1 33.5 323.0 Customers Customer 145.8 16.1 97.9 26.6 25.2 8.4 320.0 9.5 24.2 0.2 33.9 353.9 Deposits RWAs 32.7 18.1 78.5 8.6 9.5 35.2 182.6 34.5 9.6 1.5 45.6 228.2 LDR 91% 117% 102% 46% 35% n.m. 90% n.m. 85% n.m. 99% 91% Adj. RoE (%)(3,4,5) 28% 5% 5% 5% 10% (3%) 9% n.m. n.m. n.m. n.m. 8.6% Adj. Cost : Income ratio 58% 106% 64% 91% 64% 108% 69% n.m. 45% n.m. n.m. 67% (3,4) (%) (1) ‘Williams and Glyn’ refers to the business formerly intended to be divested as a separate legal entity and comprises RBS England and Wales branch-based businesses along with certain small and medium (2) (3) enterprises and corporate activities across the UK Central items include unallocated costs and assets which principally comprise volatile items under IFRS Excluding own credit adjustments, gains/(losses) on redemption of own debt and strategic disposals (4) Excluding restructuring costs and litigation and conduct costs and goodwill (5) RBS’s CET1 target is 13% but for the purposes of computing segmental return on equity (RoE), to better reflect the differential drivers of capital usage, segmental operating profit after tax and adjusted for preference dividends is divided by notional equity allocated at different rates of 11% 19 (Commercial Banking and Ulster Bank RoI), 12% (RBS International) and 15% for all other segments, of the monthly average of segmental risk-weighted assets after capital deductions (RWAes) *Totals may not cast due to rounding

Q4 2016 results by business – Natwest Markets Core Franchises Total Other Total RBS Ulster Commercial Private RBS NatWest Total Core Capital Central Total (1) (£bn) UK PBB Bank RoI Banking Banking International Markets Franchises Resolution W&G items & Other (2) other (3) Adj. Income 1.3 0.1 0.9 0.2 0.1 0.3 2.9 (0.3) 0.2 0.5 0.4 3.3 Adj. Operating (0.8) (0.1) (0.6) (0.1) (0.1) (0.3) (2.0) (0.2) (0.1) 0.1 (0.2) (2.2) expenses(4) Impairment (losses) / (0.0) 0.0 (0.1) 0.0 0.0 - (0.0) 0.1 (0.0) (0.0) 0.1 0.1 releases Adj. operating 0.5 0.0 0.2 0.0 0.0 (0.0) 0.8 (0.3) 0.1 0.6 0.3 1.2 profit(3,4) Funded Assets(5) 155.6 24.0 150.5 18.5 23.4 100.9 472.9 27.6 25.8 25.4 78.8 551.7 Net L&A to 132.1 18.9 100.1 12.2 8.8 17.4 289.5 12.8 20.6 0.1 33.5 323.0 Customers Customer 145.8 16.1 97.9 26.6 25.2 8.4 320.0 9.5 24.2 0.2 33.9 353.9 Deposits RWAs 32.7 18.1 78.5 8.6 9.5 35.2 182.6 34.5 9.6 1.5 45.6 228.2 LDR 91% 117% 102% 46% 35% n.m. 90% n.m. 85% n.m. 99% 91% Adj. RoE (%)(3,4,5) 28% 5% 5% 5% 10% (3%) 9% n.m. n.m. n.m. n.m. 8.6% Adj. Cost : Income ratio 58% 106% 64% 91% 64% 108% 69% n.m. 45% n.m. n.m. 67% (3,4) (%) (1) ‘Williams and Glyn’ refers to the business formerly intended to be divested as a separate legal entity and comprises RBS England and Wales branch-based businesses along with certain small and medium (2) (3) enterprises and corporate activities across the UK Central items include unallocated costs and assets which principally comprise volatile items under IFRS Excluding own credit adjustments, gains/(losses) on redemption of own debt and strategic disposals (4) Excluding restructuring costs and litigation and conduct costs and goodwill (5) RBS’s CET1 target is 13% but for the purposes of computing segmental return on equity (RoE), to better reflect the differential drivers of capital usage, segmental operating profit after tax and adjusted for preference dividends is divided by notional equity allocated at different rates of 11% 20 (Commercial Banking and Ulster Bank RoI), 12% (RBS International) and 15% for all other segments, of the monthly average of segmental risk-weighted assets after capital deductions (RWAes) *Totals may not cast due to rounding

Williams & Glyn Income Statement (£m) FY 2016 Comments Total Income 837 TNAV down 6p and CET1 down o/w Retail 480 30bps due to £750m restructuring o/w Commercial 357 provision taken in respect of the Total adjusted operating costs 393 17 February 2017 update on Adj. Operating profit 402 RBS’s remaining State Aid Operating profits reported 345 obligation Adj. cost : income(1) (%) 47% New package to replace Balance Sheet (£bn) divestment obligation is currently Total RWAs (£bn) 9.6 a proposal from HMT to the EC o/w Credit RWAs 8.2 EC decision to open investigation o/w Corporates 5.8 does not pre-judge the outcome Total Loans (£bn) 20.8 If plan approved, HMT will need o/w Retail loans 12.3 to renegotiate a new State Aid o/w Commercial loans 8.5 agreement - this could take until Q4 2017 or longer (1) 21 Only reflects the marginal costs of running the business

Financial Targets - 2017 and 2020 Net lending growth in PBB / CPB: 3%(1) in 2017; driven by strong mortgage growth and selected Commercial segments Operating costs: reduction in operating costs by £750m(2) in 2017, and £2bn over the next 4 years; majority achieved against combined PBB, CPB and NWM businesses (3) Capital Resolution: reduce RWAs (ex Alawwal Bank stake ) to £15-20bn and wind-up at end Q4 2017 Significant one-off issues resolved in 2016; 2017 expected to be last peak year of one-off costs. Consequently we expect the bank to be profitable in 2018 2020 targets – foundations to achieve 12+%(4) ROTE; sub-50% cost:income ratio Reduce Core RWAs by a gross £20bn by Q4 2018 (1) (2) Lending growth target is after including the impact of balance sheet reductions with the RWA reduction target across PBB, CPB and NWM are outlined in the outlook statement. Cost saving target and (3) (4) progress in 2017 calculated using operating expenses excluding restructuring costs, litigation and conduct costs, write down of goodwill and 2016 VAT release Previously named Saudi Hollandi Bank 12%+ is the non adjusted, ‘as reported’ RoTE 2020 target. Note: The targets, expectations and trends discussed in this presentation represent management’s current expectations and are subject to change, including 22 as a result of the factors described in this document and in the “Risk Factors” 432 to 463 of the Annual Report and Accounts 2016. These statements constitute forward looking statements, please see Forward Looking Statements.

Four foundations to achieve 2020 targets Resolve legacy issues and expense one-off costs, bulk of residual targeted to be expensed in 2017 Accelerate income momentum through enhanced customer servicing in the core bank Achieve significant further cost efficiency, with accelerating JAWS from 2017 across the 3 core businesses Improve RWA productivity across PBB, CPB and NWM – achieve a further gross £20bn reduction in the core bank by end Q4 2018 (pre any offsetting volume growth) 2020 target operating profile 12+% Sub-50% C:I 13% CET1 ROTE(1) ratio ratio (1) 23 12%+ is the non adjusted, ‘as reported’ RoTE 2020 target

Resolve legacy issues and expense one-off costs One-off cost Comment c.£2bn over 2017 to 2019 (excluding W&G); Restructuring costs of which c.£1bn in 2017 Partially related to exiting head office properties with onerous lease terms £2.0bn of lifetime disposal costs; of which Capital Resolution disposal costs £1.2bn taken by end 2016 Majority of residual expected to be in 2017 £750m restructuring provision taken in W&G respect of the 17 February 2017 update on RBS’s remaining State Aid obligation Substantial number of issues progressed in Conduct costs 2016 2017 expected to be peak of remaining legacy conduct costs 24

Core income momentum NIM: Sharp improvement in 5 and 10 year swap rate reduces forward looking headwinds from roll-off of existing structural hedging; SVR 12% of book Volumes: 3% net lending growth target for combined PBB/CPB in 2017 - expect to continue to achieve market share gains in targeted customer segments Net interest income: Volume benefit outweighs NIM pressure Fees & commission: Headwinds from interchange alleviates from 2017 onwards Revenues in NWM: Benefiting from market volatility and continued active customer flows 25

Achieve further significant cost efficiency Adjusted operating costs (£bn) £3.1bn cost reduction achieved over 3 8.4(1) years to 2016; 2017 cost reduction 0.4 W&G target of £750m 0.8 Capital Resolution Significant further cost efficiency 1.3 NWM across PBB and CPB through PBB+CPB digitisation, process simplification and Central items & other automation NatWest Markets are currently in the middle of a substantial investment programme which will equip the franchise for new regulatory 6.1 requirements and provide opportunity to reduce back office support costs NWM adjusted costs expected to reduce to ~£800m over the next four Excluding years, as we continue to take out £227m VAT organic costs and the currently (0.1) recovery expensed investment spend goes away by 2018 FY 2016 26 (1) Numbers may not cast due to rounding

Improve RWA efficiency across PBB, CPB and NWM Core Bank RWAs (£bn) Target gross £20bn RWA reduction by end 183(1) (20) Q4 2018, with some offsetting volume UK PBB 33 163 growth Improving RWA efficiency underpins Ulster Bank 18 improved returns and mitigates potential impact of RWA regulatory tightening from 2019 onwards Commerical 79 Expect income loss to be relatively modest given much of the reduction is from: Private - The exiting of low ROE lending pools Banking 9 - Improving risk metrics in certain RBSI 10 portfolios including Ireland NWM 35 - Continuing benefits from data clean-up 2016 Target FY 2018 - Improvement in the quality of our risk reduction (pre-growth) models 27 (1) Numbers may not cast due to rounding

Financial Targets - 2020 12%+ Sub-50% ROTE(1) Cost:Income Ratio 28 (1) 12%+ is the non adjusted and ‘as reported’ target

Ross McEwan Chief Executive Officer

Summary(1) Fundamentals of our strategy remain unchanged Progress in dealing with legacy issues Financial targets hit three years running - costs down, capital solid, lending and income growth in core bank Further on costs, faster on digital transformation to deliver a better customer experience Targeting profitability in 2018, and achieving 12%+ ROTE and sub-50% C:I by 2020 (1) The targets, expectations and trends discussed in this presentation represent management’s current expectations and are subject to change, including as a result of the factors described in this 30 document and in the “Risk Factors” 432 to 463 of the Annual Report and Accounts 2016. These statements constitute forward looking statements, please see Forward Looking Statements.

Appendix

FY 2016 results by business Core Franchises Total Other Total RBS Ulster Commercial Private RBS NatWest Total Core Capital Central (£bn) UK PBB Bank RoI Banking Banking International Markets Franchises Resolution W&G(1) items & Total Other (2) other (3) Adj. Income 5.3 0.6 3.4 0.7 0.4 1.5 11.8 (0.4) 0.8 0.1 0.5 12.4 Adj. Operating (3.0) (0.5) (1.9) (0.5) (0.2) (1.3) (7.4) (0.8) (0.4) 0.3 (0.8) (8.2) expenses(4) Impairment (losses) / (0.1) 0.1 (0.2) 0.0 (0.0) - (0.2) (0.3) (0.0) - (0.3) (0.5) releases Adj. operating 2.2 0.2 1.3 0.1 0.2 0.2 4.2 (1.4) 0.4 0.5 (0.6) 3.7 (3,4) profit Funded Assets(5) 155.6 24.0 150.5 18.5 23.4 100.9 472.9 27.6 25.8 25.4 78.8 551.7 Net L&A to Customers 132.1 18.9 100.1 12.2 8.8 17.4 289.5 12.8 20.6 0.1 33.5 323.0 Customer Deposits 145.8 16.1 97.9 26.6 25.2 8.4 320.0 9.5 24.2 0.2 33.9 353.9 RWAs 32.7 18.1 78.5 8.6 9.5 35.2 182.6 34.5 9.6 1.5 45.6 228.2 LDR 91% 117% 102% 46% 35% n.m. 90% n.m. 85% n.m. 99% 91% Adj. RoE (%)(3,4,5) 27% 8% 8% 8% 14% 1% 11% n.m. n.m. n.m. n.m. 1.6% Adj. Cost : Income 57% 80% 57% 78% 45% 87% 63% n.m. 47% n.m. n.m. 66% (3,4) ratio (%) (1) ‘Williams and Glyn’ refers to the business formerly intended to be divested as a separate legal entity and comprises RBS England and Wales branch-based businesses along with certain small and medium (2) (3) enterprises and corporate activities across the UK Central items include unallocated costs and assets which principally comprise volatile items under IFRS Excluding own credit adjustments, gains/(losses) on redemption of own debt and strategic disposals (4) Excluding restructuring costs and litigation and conduct costs and goodwill (5) RBS’s CET1 target is 13% but for the purposes of computing segmental return on equity (RoE), to better reflect the differential drivers of capital usage, segmental operating profit after tax and adjusted for preference dividends is divided by notional equity allocated at different rates of 11% 33 (Commercial Banking and Ulster Bank RoI), 12% (RBS International) and 15% for all other segments, of the monthly average of segmental risk-weighted assets after capital deductions (RWAes) *Totals may not cast due to rounding

Q4 2016 results by business Core Franchises Total Other Total RBS Ulster Commercial Private RBS NatWest Total Core Capital Central Total (1) (£bn) UK PBB Bank RoI Banking Banking International Markets Franchises Resolution W&G items & Other (2) other (3) Adj. Income 1.3 0.1 0.9 0.2 0.1 0.3 2.9 (0.3) 0.2 0.5 0.4 3.3 Adj. Operating (0.8) (0.1) (0.6) (0.1) (0.1) (0.3) (2.0) (0.2) (0.1) 0.1 (0.2) (2.2) expenses(4) Impairment (losses) / (0.0) 0.0 (0.1) 0.0 0.0 - (0.0) 0.1 (0.0) (0.0) 0.1 0.1 releases Adj. operating 0.5 0.0 0.2 0.0 0.0 (0.0) 0.8 (0.3) 0.1 0.6 0.3 1.2 profit(3,4) Funded Assets(5) 155.6 24.0 150.5 18.5 23.4 100.9 472.9 27.6 25.8 25.4 78.8 551.7 Net L&A to 132.1 18.9 100.1 12.2 8.8 17.4 289.5 12.8 20.6 0.1 33.5 323.0 Customers Customer 145.8 16.1 97.9 26.6 25.2 8.4 320.0 9.5 24.2 0.2 33.9 353.9 Deposits RWAs 32.7 18.1 78.5 8.6 9.5 35.2 182.6 34.5 9.6 1.5 45.6 228.2 LDR 91% 117% 102% 46% 35% n.m. 90% n.m. 85% n.m. 99% 91% Adj. RoE (%)(3,4,5) 28% 5% 5% 5% 10% (3%) 9% n.m. n.m. n.m. n.m. 8.6% Adj. Cost : Income ratio 58% 106% 64% 91% 64% 108% 69% n.m. 45% n.m. n.m. 67% (3,4) (%) (1) ‘Williams and Glyn’ refers to the business formerly intended to be divested as a separate legal entity and comprises RBS England and Wales branch-based businesses along with certain small and medium (2) (3) enterprises and corporate activities across the UK Central items include unallocated costs and assets which principally comprise volatile items under IFRS Excluding own credit adjustments, gains/(losses) on redemption of own debt and strategic disposals (4) Excluding restructuring costs and litigation and conduct costs and goodwill (5) RBS’s CET1 target is 13% but for the purposes of computing segmental return on equity (RoE), to better reflect the differential drivers of capital usage, segmental operating profit after tax and adjusted for preference dividends is divided by notional equity allocated at different rates of 11% 34 (Commercial Banking and Ulster Bank RoI), 12% (RBS International) and 15% for all other segments, of the monthly average of segmental risk-weighted assets after capital deductions (RWAes) *Totals may not cast due to rounding

Notable items - Income (£m) FY 2016 FY 2015 Q4 2016 Q3 2016 Q4 2015 Total Income 12,590 12,923 3,216 3,310 2,484 Own Credit Adjustments 180 309 (114) (156) (115) Gain/(Loss) on redemption of own debt (126) (263) 1 3 (263) Strategic disposals 164 (157) - (31) (22) o/w Visa Gain 246 - - - - o/w Cap Res (81) (38) - (30) (24) Adjusted Income 12,372 13,034 3,329 3,494 2,884 IFRS volatility in Central items (510) 15 308 (150) 59 Funding valuation adjustments in Capital Resolution (170) - - 160 - FX gain in Central items 349 14 140 (44) 54 FX reserve gain in Central items 97 - - 97 - Capital Resolution (572) (367) (325) (143) (180) Disposal gain/(losses) in adjusted income 35 Note: “-” Denotes zero or not material

Notable items - Expenses (£m) FY 2016 FY 2015 Q4 2016 Q3 2016 Q4 2015 Total Expenses (16,194) (16,353) (7,354) (2,911) (5,761) Restructuring (2,106) (2,931) (1,007) (469) (614) o/w Williams & Glyn (1,456) (658) (810) (301) (209) Litigation & Conduct (5,868) (3,568) (4,128) (425) (2,124) o/w US RMBS (3,300) (2,100) (3,051) (249) (1,500) o/w RBS’ treatment of SME’s (400) - (400) - - o/w PPI (601) (600) (201) - (500) o/w Ulster mortgage tracker (172) - (77) - - Writedown of Goodwill - (498) - - (498) Adjusted Expenses (8,220) (9,356) (2,219) (2,017) (2,525) o/w central VAT recovery 227 - - - - Bank Levy (190) (230) (190) - (230) o/w UK PBB (34) (45) (34) - (45) o/w Ulster Bank RoI (3) (9) (3) - (9) o/w Commercial (90) (103) (90) - (103) o/w Private (19) (22) (19) - (22) o/w RBSI (19) (18) (19) - (18) o/w CIB (13) (24) (13) - (24) o/w Capital Resolution (22) (43) (22) - (43) o/w Central 10 34 10 - 34 Impairments (478) 727 75 (144) 327 Capital Resolution (253) 725 130 (120) 356 o/w Shipping Portfolio (treated as part of disposal losses) (424) (82) 30 (190) (83) Ulster Bank RoI 113 141 47 39 10 Commercial (206) (69) (83) (20) (27) 36

Tangible Net Asset Value (TNAV) movements Q3 2016 Q4 2015 £m Shares in TNAV per £m Shares in TNAV per issue (m) share issue (m) share Starting TNAV 39,822 11,792 338p 40,943 11,625 352p (1) (4,237) (36p) (5,089) (43p) Loss for the period post tax Less: profit to NCI / other owners (134) (1p) (1,707) (14p) (503) (4p) 1,067 9p Other comprehensive Income o/w AFS 68 1p (94) (1p) o/w Cashflow hedging gross of tax (750) (6p) 765 6p 11p o/w FX (13) - 1,263 o/w Remeasurement of net defined - (2) (1,049) (9p) pension liability 2p 2p 194 182 o/w Tax Less: OCI attributable to NCI / other owners 9 - (111) (1p) Redemption of preference shares - - - (420) (4p) Proceeds of share issuance 61 31 (1p) 466 198 (2p) (2) (36) - (167) (1p) Other movements Q4 2016 Q4 2016 End of period TNAV 34,982 11,823 296p 34,982 11,823 296p 37 (1) . (2) Loss for the period is pre non controlling interests and other owners dividends and excludes write-down of goodwill and other intangible assets Other reserve movements including intangibles.

Structural hedging - Interest rate sensitivity Structural Hedge Sensitivity of Net interest income to interest rate changes (£bn) Product hedge Equity hedge 122 122 123 Sensitivity (£m) + 25 basis point shift in yield curves 96 87 88 90 − 25 basis point shift in yield curves (236) + 100 basis point shift in yield curves 500 35 34 33 − 100 basis point shift in yield curves (378) Q2 2016 Q3 2016 Q4 2016 Structural hedges of £123bn as at 31 December 2016 generated a benefit of £1.3bn through net interest income for the year Around 73% of these hedges are part of a five year rolling hedge programme and around 27% as part of a 10 year hedge that will progressively roll-off over the coming years At 31 December 2016, the 5-year swap rate was 0.74% compared with 1.45% one year previously. The market rate matching the amortising structure of the hedge was 0.60% 38

CET1 and leverage ratios CET1 Ratio Leverage Ratio +480bps +170bps 13.4% 13.0% 5.1% 8.6% 3.4% FY 2013 FY 2016 Target FY 2013 FY 2016 39

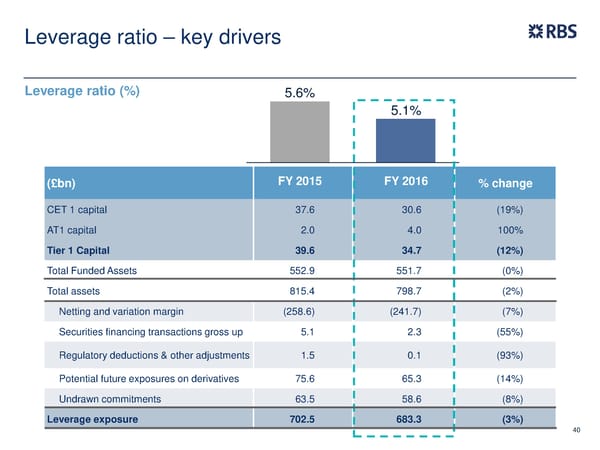

Leverage ratio – key drivers Leverage ratio (%) 5.6% 5.1% (£bn) FY 2015 FY 2016 % change CET 1 capital 37.6 30.6 (19%) AT1 capital 2.0 4.0 100% Tier 1 Capital 39.6 34.7 (12%) Total Funded Assets 552.9 551.7 (0%) Total assets 815.4 798.7 (2%) Netting and variation margin (258.6) (241.7) (7%) Securities financing transactions gross up 5.1 2.3 (55%) Regulatory deductions & other adjustments 1.5 0.1 (93%) Potential future exposures on derivatives 75.6 65.3 (14%) Undrawn commitments 63.5 58.6 (8%) Leverage exposure 702.5 683.3 (3%) 40

Credit risk FY 2016 REILs FY 2016 Ulster ROI REILs £bn (as % of Total Gross L&As) £bn (as % of Total Gross L&As) (74%) (54%) (28.5%) 39.4 (9.4%) 7.6 Capital Resolution 20.3 Ex Capital 3.5(17.4%) Resolution 10.3 (3.1%) 19.1 2.3 8.0 FY 2013 FY 2016 (1) FY 2013 FY 2016 Excluding Ulster Bank ROI and Capital Resolution the REIL ratio is 1.5% (1) 41 In 2016 Ulster Bank ROI widened the definition of non-performing loans which are considered to be impaired to include multiple forbearance arrangements and probationary mortgages.

Reduction of Capital Resolution RWAs RWAs, £bn Loan portfolios(1) Alawwal Bank Shipping Other 49 Markets Operational risk 6 GTS 4 35(2) 3 3 21 16 ~15-20 4 1 7 8 4 3 2 3 Q4 2015 Q4 2016 2017 Target(3) Target of £15-20bn of RWAs excluding Alawwal Bank by end 2017 (1) (2) (3) 42 Loan portfolios include APAC, EMEA, Americas and Legacy May not cast due to rounding 2017 target excludes the disposal of Alawwal Bank

FY 2016 Adjusted Operating costs Reduction in Adjusted Operating Costs, £bn W&G Reduction in operating costs by £750m in 2017; majority achieved against Capital Resolution combined PBB, CPB and NWM businesses Central items 11.9 Other reduction NWM (1) Core business ex.NWM (0.4) (1.1) 10.4 (1.0)(2) 0.3 9.4 (1.0)(3) Organic 2.0 0.4 8.4(4) (0.75) reduction 1.5 7.7 0.4 0.2 0.8 0.4 1.7 1.5 1.3 6.0 5.9 6.1 Excluding £227m VAT recovery 2013 2014 2015 (0.1) 2017 Adj. C:I 2016 Target(5) Ratio 72% 69% 72% 66% (1) (2) (3) £0.4bn is made up of the benefit of lower intangible asset write-offs of 2013-£344m, 2014-£146m as well as the year on year benefit of FX. This includes £71m lower intangible write offs offset by £29m growth in W&G. Excluding litigation and (4) (5) conduct costs, restructuring costs, write down of goodwill and other intangible assets, 2016 VAT release and the operating costs of Williams & Glyn Numbers may not cast due to rounding The targets, expectations and trends discussed in this 43 section represent management’s current expectations and are subject to change, including as a result of the factors described in this document and in the “Risk Factors” on pages 432 to 463 of the Annual Report and Accounts 2016. These statements constitute forward looking statements, please see Forward Looking Statements on pages 64 and 65 of the company announcement.

Restructuring costs (ex.W&G) vs. annual cost saving 2014 - 2016 £bn 3.9 Cost saving achieved in given year Cumulative cost saving 3.1 0.75 2.1 1.0 1.0 3.1 Annual cost 1.1 2.1 saving 1.1 2014 2015 2016 2017(1) Cumulative Restructuring 0.8 3.1 3.7 4.7 costs We expect to incur restructuring costs of approximately £1bn in 2017 and approximately a further £1bn in aggregate during 2018 and 2019 (1) The targets, expectations and trends discussed in this presentation represent management’s current expectations and are subject to change, including as a result of the factors described in this document and in 44 the “Risk Factors” 432 to 463 of the Annual Report and Accounts 2016. These statements constitute forward looking statements, please see Forward Looking Statements.

NPS Net Promoter Scores across our core businesses 30 Personal Banking(1) Business Banking(2) Commercial Banking(3) 20 18 21 20 13 12 11 13 15 10 9 9 9 9 4 4 0 (2) (4) (4) (4) (2) (9) (6) (7) (7) (7) (10) (5) (10) Royal Bank of Scotland (Scotland) NatWest (England & Wales) (20) RBSG (GB) (20) (30) (30) Q4 Q1 Q2 Q3 Q4 Q4 Q1 Q2 Q3 Q4 Q4 Q1 Q2 Q3 Q4 2015 2016 2015 2016 2015 2016 (1) Personal Banking: Source GfK FRS, 6 month roll. Latest base sizes: NatWest (England & Wales) (3313), Royal Bank of Scotland (Scotland) (527) Question “How likely is it that you would to recommend (brand) to a relative, friend or colleague in the next 12 months for current account banking?” Base: Claimed main banked current account customers. The year on year improvement in NatWest Personal Banking is significant. (2+3) (3) Business & Commercial Banking: Source Charterhouse Research Business Banking Survey, quarterly rolling. Latest base sizes, Business £0-2m NatWest (1258) Royal Bank of Scotland (422) Commercial 45 £2m+ combination of NatWest & Royal Bank of Scotland in GB (935) Question: “How likely would you be to recommend (bank)”. Base: Claimed main bank. Data weighted by region and turnover to be representative of businesses in Great Britain. The year on year improvement in RBSG Commercial Banking is significant.

(1) Outlook – 2017 (1/2) Subject to providing fully for the remaining legacy issues, including RMBS exposures and State Aid obligations relating to W&G in particular, RBS currently expects that 2017 will be its final year of substantive clean up with significant one-off costs. Consequently, we anticipate that the bank will be profitable in 2018 Targeting net loans and advances growth of 3% across PBB and CPB, including the impact of balance sheet reductions associated with the RWA reduction target We expect that income in 2017 will continue to be supported by balance sheet growth across PBB and CPB (2) Plan to reduce operating costs by a further £750m in 2017 Net impairment charges should remain meaningfully below normalised levels in 2017. However, we expect the level of net impairment charges to be driven by a combination of increased gross charges and a materially reduced benefit from releases (1) The targets, expectations and trends discussed in this presentation represent management’s current expectations and are subject to change, including as a result of the factors described in this document 46 and in the “Risk Factors” 432 to 463 of the Annual Report and Accounts 2016. These statements constitute forward looking statements, please see Forward Looking Statements.

(1) Outlook – 2017 (2/2) Cumulative Capital Resolution disposal losses will total c.£2bn since the beginning of 2015, with £1.2bn incurred to date, with most of the balance incurred in 2017 Expect to incur restructuring costs (ex.W&G) of c.£1bn in 2017 and approximately a further £1bn across 2018 and 2019 If the proposal in respect of W&G is accepted, we expect to incur additional restructuring costs Target CET1 of at least 13% at end 2017, RBS submitted a revised capital plan as part of the 2016 BoE stress tests which was accepted by the PRA Board RBS issuance needs for 2017 focus on issuing £3-5bn MREL compliant Senior HoldCo Continue to deal with range of significant risks and uncertainties in the external economic, political and regulatory environment and manage conduct-related investigations and litigation including RMBS (1) The targets, expectations and trends discussed in this presentation represent management’s current expectations and are subject to change, including as a result of the factors described in this document 47 and in the “Risk Factors” 432 to 463 of the Annual Report and Accounts 2016. These statements constitute forward looking statements, please see Forward Looking Statements.

(1) Outlook – Medium Term Target achieving our sub 50% cost:income ratio and 12% return targets in 2020 on an unadjusted basis, one year later than originally planned Expect to be able to grow volumes faster than market growth rates over the coming years underpinned by our ability to grow the PBB and CPB balance sheet Plan to reduce adjusted expenses in the order of £2bn in the next four years with around two thirds of this applicable to the Core Bank Targeting a gross RWA reduction across 3 core businesses of at least £20bn by Q4 2018 with some off-setting volume growth We continue to monitor the ongoing discussions around the potential further tightening of regulatory capital rules and recognise that this could result in RWA inflation in the medium term In view of the significant risks and uncertainties in the external economic, political and regulatory environment including uncertainties around the final resolution of RMBS exposures and residual State Aid obligations relating to W&G, the timing of returning excess capital to shareholders through dividends or buybacks remains uncertain (1) The targets, expectations and trends discussed in this presentation represent management’s current expectations and are subject to change, including as a result of the factors described in this document 48 and in the “Risk Factors” 432 to 463 of the Annual Report and Accounts 2016. These statements constitute forward looking statements, please see Forward Looking Statements.

Growth and risk profile New mortgage lending 2016 (average LTV by weighted value), £bn 71% 74% 70% 70% 69% 62% 59% 62% 62% 61% 55% 54% UK PBB Ulster Bank Private RBSI W&G Total ROI Owner occupied average LTV by weighted value Buy to let average LTV by weighted value 49

Fixed Income Investor Presentation FY 2016 Results 24 February 2017

Core credit messages Diversified income streams Three core franchises generating stable and attractive returns Well progressed on legacy clean-up and improving balance sheet resilience Credit and market risk positioned appropriately for less certain macro outlook 2020 Target Operating Profile 12+% ROTE Sub-50% C:I 13% CET1 ~85% RWAs in ~90% Income ratio ratio PBB & CPB from UK 51

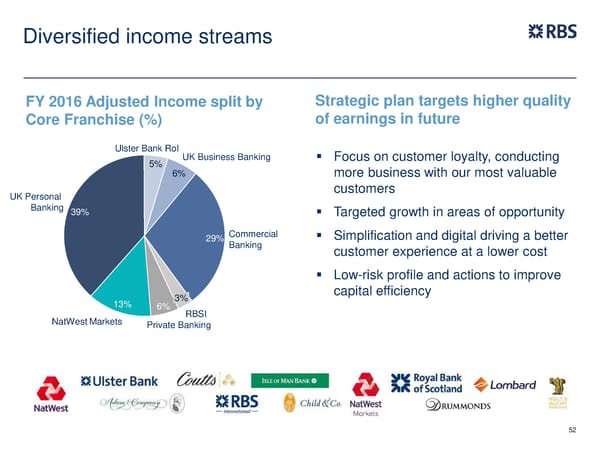

Diversified income streams FY 2016 Adjusted Income split by Strategic plan targets higher quality Core Franchise (%) of earnings in future Ulster Bank RoI UK Business Banking Focus on customer loyalty, conducting 5% 6% more business with our most valuable UK Personal customers Banking 39% Targeted growth in areas of opportunity 29% Commercial Simplification and digital driving a better Banking customer experience at a lower cost Low-risk profile and actions to improve 3% capital efficiency 13% 6% NatWest Markets RBSI Private Banking 52

Three core businesses generating stable and attractive returns (1,2) (%) 11% 11% Core Adjusted Return on Equity 4.1 4.2 Core Adjusted operating profit(2) (£bn) 1.2 1.2 1.1 1.0 1.0 1.3 1.0(3) 0.8(3) 0.5 0.8 Q1’15 Q2’15 Q3’15 Q4’15 FY 2015 Q1’16 Q2’16 Q3’16 Q4’16 FY 2016 Core businesses averaged >£1bn operating profit for last 8 quarters (1) RBS’s CET1 target is 13% but for the purposes of computing segmental return on equity (RoE), to better reflect the differential drivers of capital usage, segmental operating profit after tax and adjusted for preference dividends is divided by notional equity allocated at different rates of 11% (Commercial Banking and Ulster Bank RoI), 12% (RBS International) and 15% for all other segments, of the monthly average of 53 (2) segmental risk-weighted assets after capital deductions (RWAes). Excluding own credit adjustments, gains/(losses) on redemption of own debt and strategic disposals. Excluding restructuring costs and litigation (3) and conduct costs and goodwill. Excluding the impact of the Bank Levy. Note: totals may not cast due to rounding.

Robert Begbie Treasurer

FY 2016 Results – Treasurer’s view Solid capital and liquidity metrics maintained Increasing focus on balance sheet optimisation Lower capital requirements reflect strategic progress 13% target CET1 ratio maintained Our issuance needs are evolving to reflect our strategic progress and future structure Target £3-5bn Senior HoldCo issuance No active need for AT1 or Tier 2 in 2017 Progressive return to funding markets 55

Solid capital and liquidity metrics maintained FY 2016 FY 2015 Loan : deposit ratio 91% 89% Short-term wholesale funding £14bn £17bn Liquidity coverage ratio 123% 136% Net stable funding ratio 121% 121% Core equity tier 1 ratio 13.4% 15.5% Leverage ratio 5.1% 5.6% 56

Reduced capital requirements reflect strategic progress Pillar 2A total capital requirement(1) 2019 ‘fully phased’ CET1 MDA floor (1.2%) (0.7%) 5.0% 10.8% 10.1% 3.8% Previous Current Previous Current Pillar 2A reduction primarily reflects contribution to pension scheme 13% target CET1 ratio maintained 57 (1) RBS’s Pillar 2A requirement was 3.8% of RWAs as at 31 December 2016. 56% of the total Pillar 2A requirement, must be met from CET1 capital. Requirement is expected to vary over time and is subject to at least annual review.

MDA phase-in and assessment of appropriate buffers Target CET1 ratio versus maximum distributable amount (“MDA”), % (3) Illustration, based on assumption of static regulatory requirements 13.4 13.0 Illustrative Illustrative (1) (1) headroom 2.9 5.0 headroom 10.1 8.4 1.0 0.5 2.5 1.3 2.1(2) 2.1(3) 10.1 8.4 G-SIB Buffer 4.5 Capital Conservation Buffer 4.5 Pillar 2A (varies at least annually) Pillar 1 minimum requirement FY 2016 "Phase In" Estimated Management 2017 MDA "Fully Phased" CET1 Target (4) 2019 MDA (1) Headroom presented on the basis of MDA, and does not reflect excess distributable capital. Headroom may vary over time and may be less in future. (2) RBS’s Pillar 2A requirement was 3.8% of RWAs as at 31 58 (3) December 2016. 56% of the total Pillar 2A requirement, must be met from CET1 capital. Pillar 2A requirement held constant over the period for illustration purposes. Requirement is expected to vary over time and is subject to at least annual review. (4) Assumes no material Counter Cyclical Buffer requirement.

Capital reorganisation planned to increase available distributable reserves 2016 evolution in RBSG (HoldCo) distributable reserves ~38 (£bn) ~30 16.3 1.2 6.0 8.0 1.1 8.0 FY 2015 Tier 1 Write down Other(1) FY 2016 Illustrative redemptions of investment benefit of capital reorganisation FY 2016 RBSG (HoldCo) distributable reserves £8.0bn vs £16.3bn at FY 2015 Capital reduction planned to reclassify up to ~£25bn share premium and ~£5bn capital redemption reserve as distributable reserves Target AGM approval in Q2, with subsequent court approval during 2017 59 (1) Includes £1.2bn to retire the Dividend Access Share

Our issuance needs in 2017 are evolving to reflect our strategic progress Issuance focussed on MREL(1) build: Target £3-5bn equivalent Senior HoldCo No active need for AT1 No active need for Tier 2 Returning to modest funding activity: Reintroduce regular secured funding Participant in the Term Funding Scheme Tactical unsecured funding Manage stack for value, balancing factors including: current & future regulatory value; relative funding cost; and Rating Agency considerations 60 (1) Minimum requirement for own funds and eligible liabilities

Target £3-5bn Senior HoldCo MREL in 2017 Illustrative future MREL requirements versus estimated existing position Based on illustrative £200bn RWA and static regulatory requirements(1) ~£24bn CRD IV & >3% Management Buffers ~£16bn Existing (non-CRR) MREL (3) MREL 11.8% £11bn ~£8bn £5bn HoldCo Tier 2 3.0% Senior AT1 2.2% £2bn Legacy Tier 2 CET1 6.6% £4bn Legacy Tier 1 2022 MREL TLAC MREL MREL (3,4) (1) (2) (2) (2) FY 2016e requirement 2019 2020 2022 (5) £5.6bn of OpCo Senior maturities in 2017; ~£13bn of maturities 2017-21 Manage stack for value, balancing factors including: current & future regulatory value; relative funding cost; and Rating Agency considerations (1) (2) Illustrative only, both RWA and future capital requirements subject to change. Based on TLAC 1 Jan 2019 = 16% RWA; MREL 1 Jan 2020 = 2x Pillar 1 and 1x Pillar 2A, MREL 1 Jan 2022 = 2x Pillar 1 and 2x Pillar 2A. Pillar 2A requirement held constant over the period for illustration purposes. Requirement is expected to vary over time and is subject to at least annual review. Note, End state requirements to be met by 1 61 January 2022 are subject to review by the end of 2020. For further information on TLAC and MREL, including associated leverage requirements, please refer to ‘Capital sufficiency’ disclosure in the 2016 Annual Report & Accounts. (3) 2020 MREL requirement not required to be met by CRDIV compliant regulatory capital. (4) For further information please see ‘Loss Absorbing Capital’ disclosure in 2016 Annual Report & (5) Accounts. For further information please refer to ‘Roll-off profile’ in 2016 Annual Report & Accounts.

Illustrative future funding structure The Royal Bank of Scotland Group plc Group Holding Company and primary issuing entity for MREL Proportional Intercompany issuance of Loss Absorbing Capital NatWest Holdings Limited NatWest Markets RBS International & Subsidiary Operating companies Plc Limited A UK and Western A leading retail & A UK and Western European centred retail & commercial banking European markets business commercial bank operating group, with leading market positions in our chosen markets and product engine for in the crown dependencies RBSG and Gibraltar Primarily deposit funded Repo funding Primarily deposit funded Liquidity managed across major operating subsidiaries Down-streamed MREL Access to wholesale Down-streamed MREL Access to wholesale markets Access to wholesale markets markets (1) (1) (1) ~80% of RWA ~15% of RWA ~5% of RWA HoldCo primary issuing entity for MREL under single point of entry resolution model Operating companies tactically utilised to support future funding need Covered bond programme to be transferred to ring-fence bank 62 (1) Based on RBS future business profile, excludes RBS Capital Resolution

Sustainable banking “Sustainability goes hand in hand with building trust. If we act irresponsibly, we will lose trust. That applies not just to how we treat our customers, but also the wider role we play in society. I want us to be supporting businesses beyond just providing finance. I want us to be part of the businesses we serve. If our business customers succeed then we succeed as a bank and the UK economy succeeds as well. It is a virtuous circle and it makes sense. It is sustainable banking.” Ross McEwan, Chief Executive “We are building a more sustainable bank; a more responsible company, doing business in a more sustainable way. We consider the long-term impacts of our actions in our decision making, and we are proud that our enterprise and financial education programmes show the difference we’re making for our customers and communities. Continuing to live by our values and providing, simple and fair banking will help us to build trust for the long term.” Kirsty Britz, Director of Sustainability 63

Sustainable banking: Board governance and oversight Sustainable banking governance sits directly under the Board and is informed by regular sessions with external stakeholders The Royal Bank of Scotland Group plc board The Royal Bank of National Scotland plc board Westminster Bank plc board Group Group Executive Group Audit Board Risk Sustainable Performance & Nominations US Risk Banking and Committee Committee Committee Remuneration Committee Committee Governance Committee Committee 6x Committee meetings / year. 4x Stakeholder engagement sessions / year. Key areas of focus are culture, people, customer This covers topics such as financial capability, and brands communication. enterprise, and building a sustainable banking culture 64

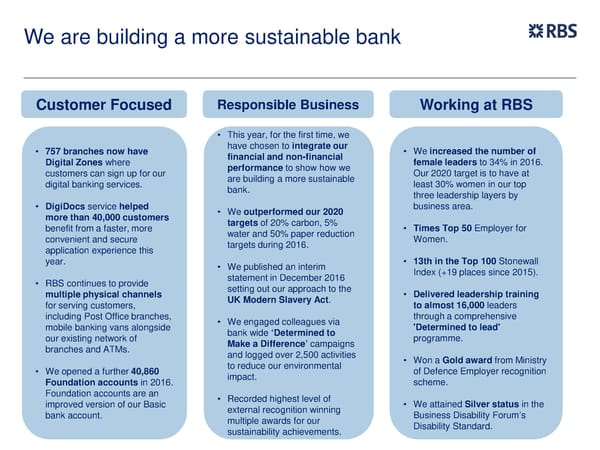

We are building a more sustainable bank Customer Focused Responsible Business Working at RBS • This year, for the first time, we have chosen to integrate our • 757 branches now have financial and non-financial • We increased the number of Digital Zones where performance to show how we female leaders to 34% in 2016. customers can sign up for our are building a more sustainable Our 2020 target is to have at digital banking services. bank. least 30% women in our top three leadership layers by • DigiDocs service helped • We outperformed our 2020 business area. more than 40,000 customers targets of 20% carbon, 5% benefit from a faster, more water and 50% paper reduction • Times Top 50 Employer for convenient and secure targets during 2016. Women. application experience this year. • We published an interim • 13th in the Top 100 Stonewall statement in December 2016 Index (+19 places since 2015). • RBS continues to provide setting out our approach to the multiple physical channels UK Modern Slavery Act. • Delivered leadership training for serving customers, to almost 16,000 leaders including Post Office branches, • We engaged colleagues via through a comprehensive mobile banking vans alongside bank wide ‘Determined to 'Determined to lead' our existing network of Make a Difference’ campaigns programme. branches and ATMs. and logged over 2,500 activities to reduce our environmental • Won a Gold award from Ministry • We opened a further 40,860 impact. of Defence Employer recognition Foundation accounts in 2016. scheme. Foundation accounts are an • Recorded highest level of improved version of our Basic external recognition winning • We attained Silver status in the bank account. multiple awards for our Business Disability Forum’s sustainability achievements. Disability Standard.

We are building a more sustainable bank We are developing leadership positions on enterprise and financial capability Supporting enterprise Building financial capability Entrepreneurial Spark Boost Financial Education Opening accounts Continued supporting UK Launched Boost - a free MoneySense, our 22 year We opened a further start-up and scale up advice and expertise flagship financial education 40,860 Foundation businesses in partnership service for small programme, has helped an accounts in 2016. with Entrepreneurial businesses – regardless of estimated 4.5 million Foundation accounts are Spark by opening 6 new whether they bank with us young people understand an improved version of our hubs in 2016, bringing the or not. all about money. Basic bank account. total to 12. Women in business Leading lender Accredited Citizen’s Advice Bureau We work in partnership We have over 400 According to InfraDeals, We have been accredited with the Citizens Advice accredited Women in RBS has been the leading by the Royal National Bureau (CAB) to ensure Business specialists in lender to the UK Institute for Blind People customers in financial the UK who offer specialist renewables sector by for having an accessible difficulty are immediately expertise in supporting number of transactions mobile app for blind and transferred to an in-house women in business. over the past 5 years partially sighted customers. CAB Advisor. (2012-2016). Skills & Opportunities 40 years Technology Act Now Our Skills & Opportunities In 2016 our partnership with We are piloting We have ‘Act Now’ text Fund distributed £2.5m to the Prince’s Trust directly innovative technologies alert service to help 125 organisations, that helped over 2,000 young to help make mortgages customers manage their support people from people, with more than 120 more accessible money and avoid charges. disadvantaged supported in running their own communities start-up in business. business or get into employment. 66

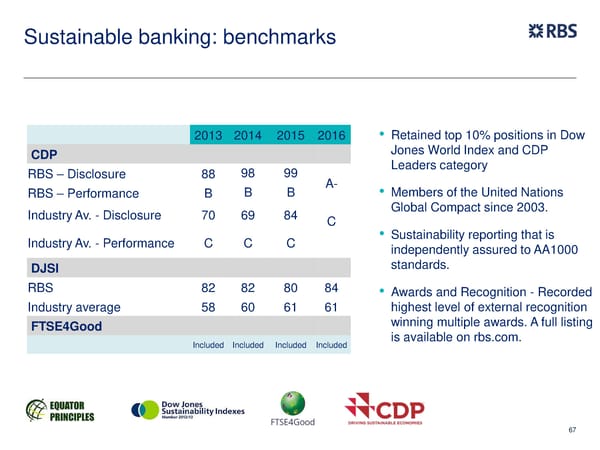

Sustainable banking: benchmarks 2013 2014 2015 2016 • Retained top 10% positions in Dow CDP Jones World Index and CDP RBS – Disclosure 88 98 99 Leaders category A- RBS – Performance B B B • Members of the United Nations Industry Av. - Disclosure 70 69 84 Global Compact since 2003. C Industry Av. - Performance C C C • Sustainability reporting that is independently assured to AA1000 DJSI standards. RBS 82 82 80 84 • Awards and Recognition - Recorded Industry average 58 60 61 61 highest level of external recognition FTSE4Good winning multiple awards. A full listing Included Included Included Included is available on rbs.com. 67

Forward Looking Statements Cautionary statement regarding forward-looking statements Certain sections in this document contain ‘forward-looking statements’ as that term is defined in the United States Private Securities Litigation Reform Act of 1995, such as statements that include the words ‘expect’, ‘estimate’, ‘project’, ‘anticipate’, ‘commit’, ‘believe’, ‘should’, ‘intend’, ‘plan’, ‘could’, ‘probability’, ‘risk’, ‘Value-at-Risk (VaR)’, ‘target’, ‘goal’, ‘objective’, ‘may’, ‘endeavour’, ‘outlook’, ‘optimistic’, ‘prospects’ and similar expressions or variations on these expressions. In particular, this document includes forward-looking statements relating, but not limited to: future profitability and performance, including financial performance targets such as return on tangible equity; cost savings and targets, including cost:income ratios; litigation and government and regulatory investigations, including the timing and financial and other impacts thereof; structural reform and the implementation of the UK ring-fencing regime; the implementation of RBS’s transformation programme, including the further restructuring of the NatWest Markets business; the satisfaction of the Group’s residual EU State Aid obligations; the continuation of RBS’s balance sheet reduction programme, including the reduction of risk-weighted assets (RWAs) and the timing thereof; capital and strategic plans and targets; capital, liquidity and leverage ratios and requirements, including CET1 Ratio, RWA equivalents (RWAe), Pillar 2 and other regulatory buffer requirements, minimum requirement for own funds and eligible liabilities, and other funding plans; funding and credit risk profile; capitalisation; portfolios; net interest margin; customer loan and income growth; the level and extent of future impairments and write-downs, including with respect to goodwill; restructuring and remediation costs and charges; future pension contributions; RBS’s exposure to political risks, operational risk, conduct risk, cyber and IT risk and credit rating risk and to various types of market risks, including as interest rate risk, foreign exchange rate risk and commodity and equity price risk; customer experience including our Net Promotor Score (NPS); employee engagement and gender balance in leadership positions. Limitations inherent to forward-looking statements These statements are based on current plans, estimates, targets and projections, and are subject to significant inherent risks, uncertainties and other factors, both external and relating to the Group’s strategy or operations, which may result in the Group being unable to achieve the current targets, predictions, expectations and other anticipated outcomes expressed or implied by such forward- looking statements. In addition certain of these disclosures are dependent on choices relying on key model characteristics and assumptions and are subject to various limitations, including assumptions and estimates made by management. By their nature, certain of these disclosures are only estimates and, as a result, actual future gains and losses could differ materially from those that have been estimated. Accordingly, undue reliance should not be placed on these statements. Forward-looking statements speak only as of the date we make them and we expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Group’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Important factors that could affect the actual outcome of the forward-looking statements We caution you that a large number of important factors could adversely affect our results or our ability to implement our strategy, cause us to fail to meet our targets, predictions, expectations and other anticipated outcomes or affect the accuracy of forward-looking statements we describe in this document including in the risk factors set out in the Group’s 2016 Annual Report and other uncertainties discussed in this document. These include the significant risks for RBS presented by the outcomes of the legal, regulatory and governmental actions and investigations that RBS is or may be subject to (including active civil and criminal investigations) and any resulting material adverse effect on RBS of unfavourable outcomes and the timing thereof (including where resolved by settlement); economic, regulatory and political risks, including as may result from the uncertainty arising from the EU Referendum; RBS’s ability to satisfy its residual EU State Aid obligations and the timing thereof; RBS’s ability to successfully implement the significant and complex restructuring required to be undertaken in order to implement the UK ring-fencing regime and related costs; RBS’s ability to successfully implement the various initiatives that are comprised in its transformation programme, particularly the proposed further restructuring of the NatWest Markets business, the balance sheet reduction programme and its significant cost-saving initiatives and whether RBS will be a viable, competitive, customer focused and profitable bank especially after its restructuring and the implementation of the UK ring-fencing regime; the exposure of RBS to cyber-attacks and its ability to defend against such attacks; RBS’s ability to achieve its capital and leverage requirements or targets which will depend in part on RBS’s success in reducing the size of its business and future profitability as well as developments which may impact its CET1 capital including additional litigation or conduct costs, additional pension contributions, further impairments or accounting changes; ineffective management of capital or changes to regulatory requirements relating to capital adequacy and liquidity or failure to pass mandatory stress tests; RBS’s ability to access sufficient sources of capital, liquidity and funding when required; changes in the credit ratings of RBS, RBS entities or the UK government; declining revenues resulting from lower customer retention and revenue generation in light of RBS’s strategic refocus on the UK; as well as increasing competition from new incumbents and disruptive technologies. In addition, there are other risks and uncertainties that could adversely affect our results, ability to implement our strategy, cause us to fail to meet our targets or the accuracy of forward-looking statements in this document. These include operational risks that are inherent to RBS’s business and will increase as a result of RBS’s significant restructuring initiatives being concurrently implemented; the potential negative impact on RBS’s business of global economic and financial market conditions and other global risks; the impact of a prolonged period of low interest rates or unanticipated turbulence in interest rates, yield curves, foreign currency exchange rates, credit spreads, bond prices, commodity prices, equity prices; basis, volatility and correlation risks; the extent of future write-downs and impairment charges caused by depressed asset valuations; deteriorations in borrower and counterparty credit quality; heightened regulatory and governmental scrutiny and the increasingly regulated environment in which RBS operates as well as divergences in regulatory requirements in the jurisdictions in which RBS operates; the risks relating to RBS’s IT systems or a failure to protect itself and its customers against cyber threats, reputational risks; risks relating to increased pension liabilities and the impact of pension risk on RBS’s capital position; risks relating to the failure to embed and maintain a robust conduct and risk culture across the organisation or if its risk management framework is ineffective; RBS’s ability to attract and retain qualified personnel; limitations on, or additional requirements imposed on, RBS’s activities as a result of HM Treasury’s investment in RBS; the value and effectiveness of any credit protection purchased by RBS; risks relating to the reliance on valuation, capital and stress test models and any inaccuracies resulting therefrom or failure to accurately reflect changes in the micro and macroeconomic environment in which RBS operates, risks relating to changes in applicable accounting policies or rules which may impact the preparation of RBS’s financial statements or adversely impact its capital position; the impact of the recovery and resolution framework and other prudential rules to which RBS is subject; the recoverability of deferred tax assets by the Group; and the success of RBS in managing the risks involved in the foregoing. The forward-looking statements contained in this document speak only as at the date hereof, and RBS does not assume or undertake any obligation or responsibility to update any forward-looking statement to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. The information, statements and opinions contained in this document do not constitute a public offer under any applicable legislation or an offer to sell or solicit of any offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments.