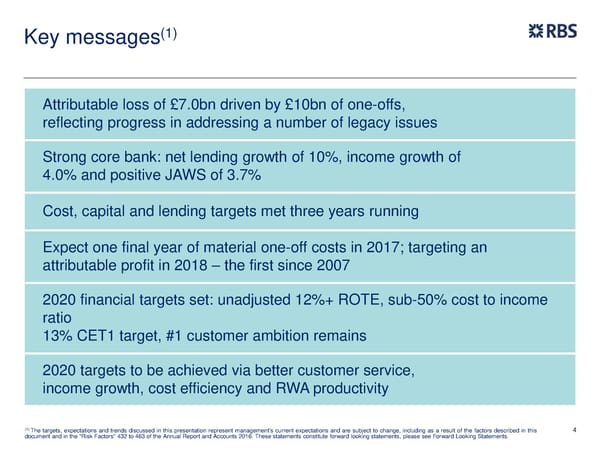

(1) Key messages Attributable loss of £7.0bn driven by £10bn of one-offs, reflecting progress in addressing a number of legacy issues Strong core bank: net lending growth of 10%, income growth of 4.0% and positive JAWS of 3.7% Cost, capital and lending targets met three years running Expect one final year of material one-off costs in 2017; targeting an attributable profit in 2018 – the first since 2007 2020 financial targets set: unadjusted 12%+ ROTE, sub-50% cost to income ratio 13% CET1 target, #1 customer ambition remains 2020 targets to be achieved via better customer service, income growth, cost efficiency and RWA productivity (1) The targets, expectations and trends discussed in this presentation represent management’s current expectations and are subject to change, including as a result of the factors described in this 4 document and in the “Risk Factors” 432 to 463 of the Annual Report and Accounts 2016. These statements constitute forward looking statements, please see Forward Looking Statements.

FY Results | RBS Group Page 4 Page 6

FY Results | RBS Group Page 4 Page 6