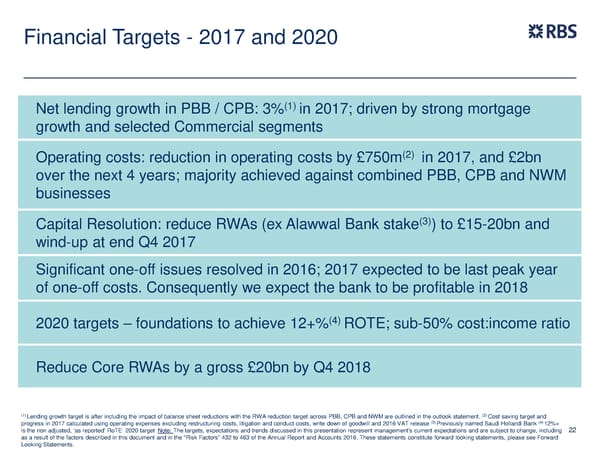

Financial Targets - 2017 and 2020 Net lending growth in PBB / CPB: 3%(1) in 2017; driven by strong mortgage growth and selected Commercial segments Operating costs: reduction in operating costs by £750m(2) in 2017, and £2bn over the next 4 years; majority achieved against combined PBB, CPB and NWM businesses (3) Capital Resolution: reduce RWAs (ex Alawwal Bank stake ) to £15-20bn and wind-up at end Q4 2017 Significant one-off issues resolved in 2016; 2017 expected to be last peak year of one-off costs. Consequently we expect the bank to be profitable in 2018 2020 targets – foundations to achieve 12+%(4) ROTE; sub-50% cost:income ratio Reduce Core RWAs by a gross £20bn by Q4 2018 (1) (2) Lending growth target is after including the impact of balance sheet reductions with the RWA reduction target across PBB, CPB and NWM are outlined in the outlook statement. Cost saving target and (3) (4) progress in 2017 calculated using operating expenses excluding restructuring costs, litigation and conduct costs, write down of goodwill and 2016 VAT release Previously named Saudi Hollandi Bank 12%+ is the non adjusted, ‘as reported’ RoTE 2020 target. Note: The targets, expectations and trends discussed in this presentation represent management’s current expectations and are subject to change, including 22 as a result of the factors described in this document and in the “Risk Factors” 432 to 463 of the Annual Report and Accounts 2016. These statements constitute forward looking statements, please see Forward Looking Statements.

FY Results | RBS Group Page 22 Page 24

FY Results | RBS Group Page 22 Page 24