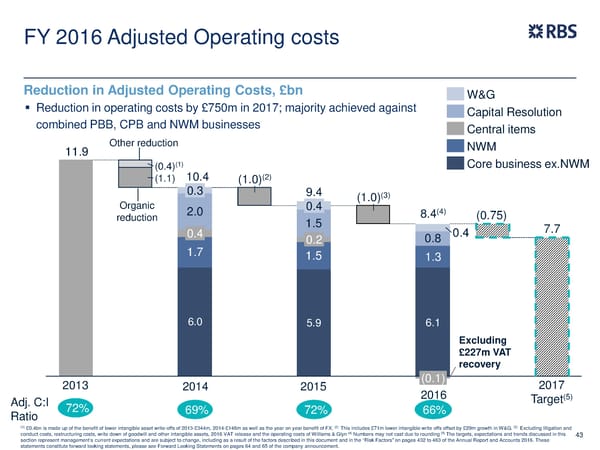

FY 2016 Adjusted Operating costs Reduction in Adjusted Operating Costs, £bn W&G Reduction in operating costs by £750m in 2017; majority achieved against Capital Resolution combined PBB, CPB and NWM businesses Central items 11.9 Other reduction NWM (1) Core business ex.NWM (0.4) (1.1) 10.4 (1.0)(2) 0.3 9.4 (1.0)(3) Organic 2.0 0.4 8.4(4) (0.75) reduction 1.5 7.7 0.4 0.2 0.8 0.4 1.7 1.5 1.3 6.0 5.9 6.1 Excluding £227m VAT recovery 2013 2014 2015 (0.1) 2017 Adj. C:I 2016 Target(5) Ratio 72% 69% 72% 66% (1) (2) (3) £0.4bn is made up of the benefit of lower intangible asset write-offs of 2013-£344m, 2014-£146m as well as the year on year benefit of FX. This includes £71m lower intangible write offs offset by £29m growth in W&G. Excluding litigation and (4) (5) conduct costs, restructuring costs, write down of goodwill and other intangible assets, 2016 VAT release and the operating costs of Williams & Glyn Numbers may not cast due to rounding The targets, expectations and trends discussed in this 43 section represent management’s current expectations and are subject to change, including as a result of the factors described in this document and in the “Risk Factors” on pages 432 to 463 of the Annual Report and Accounts 2016. These statements constitute forward looking statements, please see Forward Looking Statements on pages 64 and 65 of the company announcement.

FY Results | RBS Group Page 42 Page 44

FY Results | RBS Group Page 42 Page 44