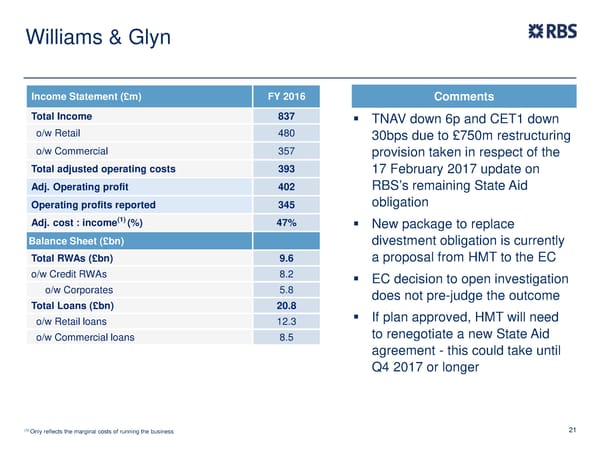

Williams & Glyn Income Statement (£m) FY 2016 Comments Total Income 837 TNAV down 6p and CET1 down o/w Retail 480 30bps due to £750m restructuring o/w Commercial 357 provision taken in respect of the Total adjusted operating costs 393 17 February 2017 update on Adj. Operating profit 402 RBS’s remaining State Aid Operating profits reported 345 obligation Adj. cost : income(1) (%) 47% New package to replace Balance Sheet (£bn) divestment obligation is currently Total RWAs (£bn) 9.6 a proposal from HMT to the EC o/w Credit RWAs 8.2 EC decision to open investigation o/w Corporates 5.8 does not pre-judge the outcome Total Loans (£bn) 20.8 If plan approved, HMT will need o/w Retail loans 12.3 to renegotiate a new State Aid o/w Commercial loans 8.5 agreement - this could take until Q4 2017 or longer (1) 21 Only reflects the marginal costs of running the business

FY Results | RBS Group Page 21 Page 23

FY Results | RBS Group Page 21 Page 23