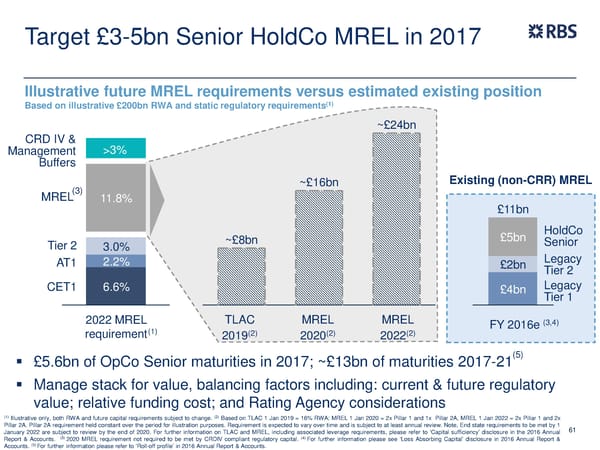

Target £3-5bn Senior HoldCo MREL in 2017 Illustrative future MREL requirements versus estimated existing position Based on illustrative £200bn RWA and static regulatory requirements(1) ~£24bn CRD IV & >3% Management Buffers ~£16bn Existing (non-CRR) MREL (3) MREL 11.8% £11bn ~£8bn £5bn HoldCo Tier 2 3.0% Senior AT1 2.2% £2bn Legacy Tier 2 CET1 6.6% £4bn Legacy Tier 1 2022 MREL TLAC MREL MREL (3,4) (1) (2) (2) (2) FY 2016e requirement 2019 2020 2022 (5) £5.6bn of OpCo Senior maturities in 2017; ~£13bn of maturities 2017-21 Manage stack for value, balancing factors including: current & future regulatory value; relative funding cost; and Rating Agency considerations (1) (2) Illustrative only, both RWA and future capital requirements subject to change. Based on TLAC 1 Jan 2019 = 16% RWA; MREL 1 Jan 2020 = 2x Pillar 1 and 1x Pillar 2A, MREL 1 Jan 2022 = 2x Pillar 1 and 2x Pillar 2A. Pillar 2A requirement held constant over the period for illustration purposes. Requirement is expected to vary over time and is subject to at least annual review. Note, End state requirements to be met by 1 61 January 2022 are subject to review by the end of 2020. For further information on TLAC and MREL, including associated leverage requirements, please refer to ‘Capital sufficiency’ disclosure in the 2016 Annual Report & Accounts. (3) 2020 MREL requirement not required to be met by CRDIV compliant regulatory capital. (4) For further information please see ‘Loss Absorbing Capital’ disclosure in 2016 Annual Report & (5) Accounts. For further information please refer to ‘Roll-off profile’ in 2016 Annual Report & Accounts.

FY Results | RBS Group Page 60 Page 62

FY Results | RBS Group Page 60 Page 62