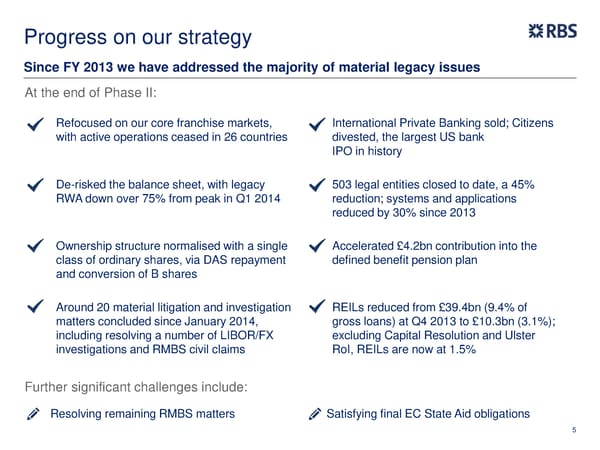

Progress on our strategy Since FY 2013 we have addressed the majority of material legacy issues At the end of Phase II: Refocused on our core franchise markets, International Private Banking sold; Citizens with active operations ceased in 26 countries divested, the largest US bank IPO in history De-risked the balance sheet, with legacy 503 legal entities closed to date, a 45% RWA down over 75% from peak in Q1 2014 reduction; systems and applications reduced by 30% since 2013 Ownership structure normalised with a single Accelerated £4.2bn contribution into the class of ordinary shares, via DAS repayment defined benefit pension plan and conversion of B shares Around 20 material litigation and investigation REILs reduced from £39.4bn (9.4% of matters concluded since January 2014, gross loans) at Q4 2013 to £10.3bn (3.1%); including resolving a number of LIBOR/FX excluding Capital Resolution and Ulster investigations and RMBS civil claims RoI, REILs are now at 1.5% Further significant challenges include: Resolving remaining RMBS matters Satisfying final EC State Aid obligations 5

FY Results | RBS Group Page 5 Page 7

FY Results | RBS Group Page 5 Page 7