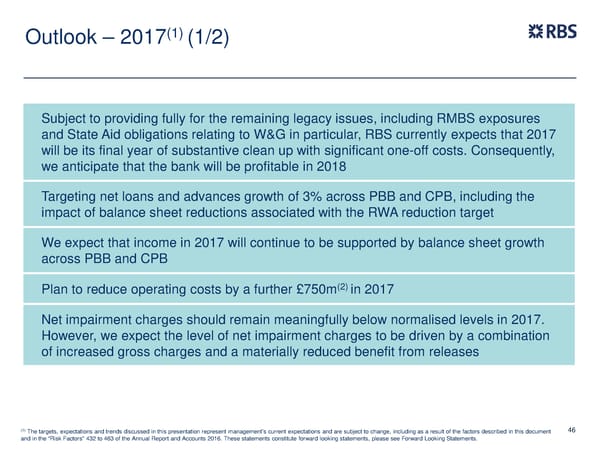

(1) Outlook – 2017 (1/2) Subject to providing fully for the remaining legacy issues, including RMBS exposures and State Aid obligations relating to W&G in particular, RBS currently expects that 2017 will be its final year of substantive clean up with significant one-off costs. Consequently, we anticipate that the bank will be profitable in 2018 Targeting net loans and advances growth of 3% across PBB and CPB, including the impact of balance sheet reductions associated with the RWA reduction target We expect that income in 2017 will continue to be supported by balance sheet growth across PBB and CPB (2) Plan to reduce operating costs by a further £750m in 2017 Net impairment charges should remain meaningfully below normalised levels in 2017. However, we expect the level of net impairment charges to be driven by a combination of increased gross charges and a materially reduced benefit from releases (1) The targets, expectations and trends discussed in this presentation represent management’s current expectations and are subject to change, including as a result of the factors described in this document 46 and in the “Risk Factors” 432 to 463 of the Annual Report and Accounts 2016. These statements constitute forward looking statements, please see Forward Looking Statements.

FY Results | RBS Group Page 45 Page 47

FY Results | RBS Group Page 45 Page 47