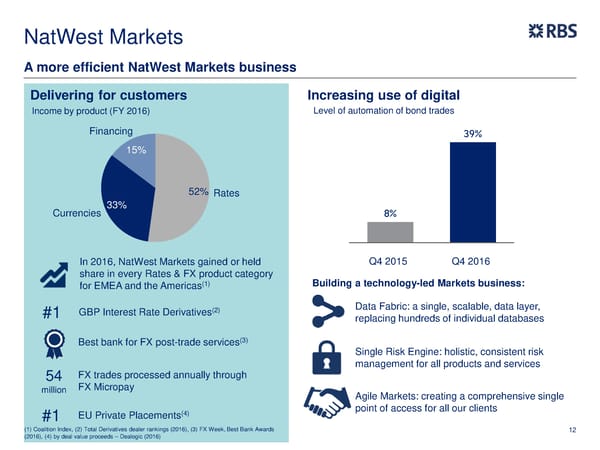

NatWest Markets A more efficient NatWest Markets business Delivering for customers Increasing use of digital Income by product (FY 2016) Level of automation of bond trades Financing 39% 15% 52% Rates Currencies 33% 8% In 2016, NatWest Markets gained or held Q4 2015 Q4 2016 share in every Rates & FX product category (1) Building a technology-led Markets business: for EMEA and the Americas (2) Data Fabric: a single, scalable, data layer, #1 GBP Interest Rate Derivatives replacing hundreds of individual databases (3) Best bank for FX post-trade services Single Risk Engine: holistic, consistent risk management for all products and services 54 FX trades processed annually through million FX Micropay Agile Markets: creating a comprehensive single (4) point of access for all our clients #1 EU Private Placements (1) Coalition Index, (2) Total Derivatives dealer rankings (2016), (3) FX Week, Best Bank Awards 12 (2016), (4) by deal value proceeds – Dealogic (2016)

FY Results | RBS Group Page 12 Page 14

FY Results | RBS Group Page 12 Page 14