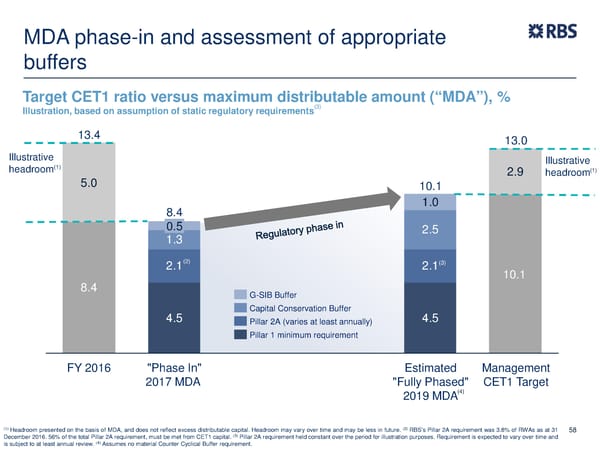

MDA phase-in and assessment of appropriate buffers Target CET1 ratio versus maximum distributable amount (“MDA”), % (3) Illustration, based on assumption of static regulatory requirements 13.4 13.0 Illustrative Illustrative (1) (1) headroom 2.9 5.0 headroom 10.1 8.4 1.0 0.5 2.5 1.3 2.1(2) 2.1(3) 10.1 8.4 G-SIB Buffer 4.5 Capital Conservation Buffer 4.5 Pillar 2A (varies at least annually) Pillar 1 minimum requirement FY 2016 "Phase In" Estimated Management 2017 MDA "Fully Phased" CET1 Target (4) 2019 MDA (1) Headroom presented on the basis of MDA, and does not reflect excess distributable capital. Headroom may vary over time and may be less in future. (2) RBS’s Pillar 2A requirement was 3.8% of RWAs as at 31 58 (3) December 2016. 56% of the total Pillar 2A requirement, must be met from CET1 capital. Pillar 2A requirement held constant over the period for illustration purposes. Requirement is expected to vary over time and is subject to at least annual review. (4) Assumes no material Counter Cyclical Buffer requirement.

FY Results | RBS Group Page 57 Page 59

FY Results | RBS Group Page 57 Page 59