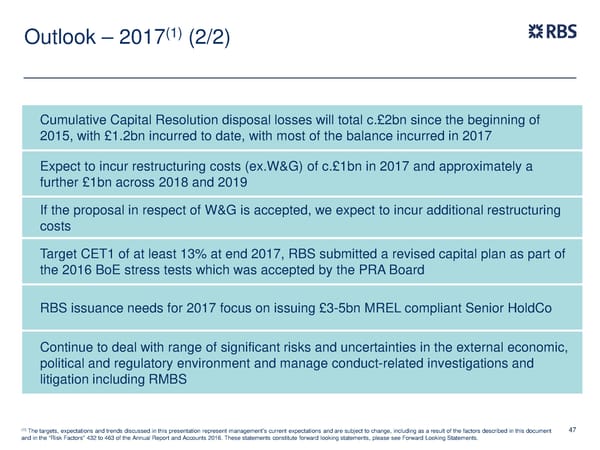

(1) Outlook – 2017 (2/2) Cumulative Capital Resolution disposal losses will total c.£2bn since the beginning of 2015, with £1.2bn incurred to date, with most of the balance incurred in 2017 Expect to incur restructuring costs (ex.W&G) of c.£1bn in 2017 and approximately a further £1bn across 2018 and 2019 If the proposal in respect of W&G is accepted, we expect to incur additional restructuring costs Target CET1 of at least 13% at end 2017, RBS submitted a revised capital plan as part of the 2016 BoE stress tests which was accepted by the PRA Board RBS issuance needs for 2017 focus on issuing £3-5bn MREL compliant Senior HoldCo Continue to deal with range of significant risks and uncertainties in the external economic, political and regulatory environment and manage conduct-related investigations and litigation including RMBS (1) The targets, expectations and trends discussed in this presentation represent management’s current expectations and are subject to change, including as a result of the factors described in this document 47 and in the “Risk Factors” 432 to 463 of the Annual Report and Accounts 2016. These statements constitute forward looking statements, please see Forward Looking Statements.

FY Results | RBS Group Page 46 Page 48

FY Results | RBS Group Page 46 Page 48