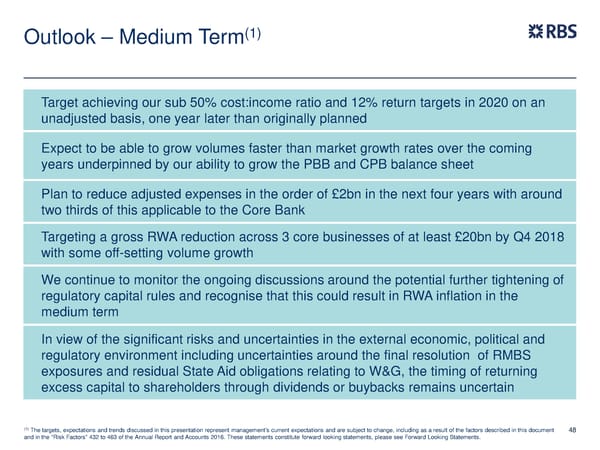

(1) Outlook – Medium Term Target achieving our sub 50% cost:income ratio and 12% return targets in 2020 on an unadjusted basis, one year later than originally planned Expect to be able to grow volumes faster than market growth rates over the coming years underpinned by our ability to grow the PBB and CPB balance sheet Plan to reduce adjusted expenses in the order of £2bn in the next four years with around two thirds of this applicable to the Core Bank Targeting a gross RWA reduction across 3 core businesses of at least £20bn by Q4 2018 with some off-setting volume growth We continue to monitor the ongoing discussions around the potential further tightening of regulatory capital rules and recognise that this could result in RWA inflation in the medium term In view of the significant risks and uncertainties in the external economic, political and regulatory environment including uncertainties around the final resolution of RMBS exposures and residual State Aid obligations relating to W&G, the timing of returning excess capital to shareholders through dividends or buybacks remains uncertain (1) The targets, expectations and trends discussed in this presentation represent management’s current expectations and are subject to change, including as a result of the factors described in this document 48 and in the “Risk Factors” 432 to 463 of the Annual Report and Accounts 2016. These statements constitute forward looking statements, please see Forward Looking Statements.

FY Results | RBS Group Page 47 Page 49

FY Results | RBS Group Page 47 Page 49