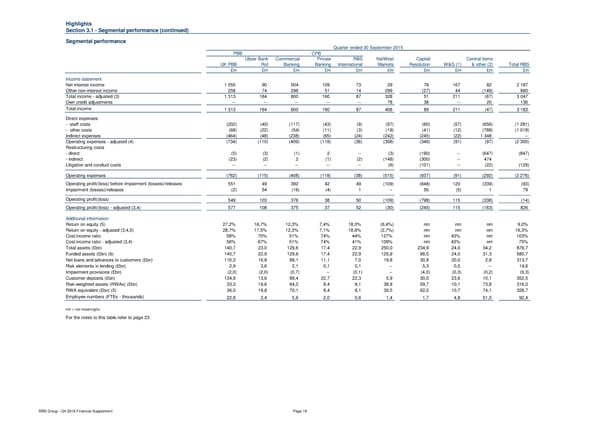

Highlights Section 3.1 - Segmental performance (continued) Segmental performance Quarter ended 30 September 2015 PBB CPB Ulster Bank Commercial Private RBS NatWest Capital Central items UK PBB RoI Banking Banking International Markets Resolution W&G (1) & other (2) Total RBS £m £m £m £m £m £m £m £m £m £m Income statement Net interest income 1 055 90 504 109 73 29 78 167 82 2 187 Other non-interest income 258 74 296 51 14 299 (27) 44 (149) 860 Total income - adjusted (3) 1 313 164 800 160 87 328 51 211 (67) 3 047 Own credit adjustments -- -- -- -- -- 78 38 -- 20 136 Total income 1 313 164 800 160 87 406 89 211 (47) 3 183 Direct expenses - staff costs (202) (40) (117) (43) (9) (97) (60) (57) (656) (1 281) - other costs (68) (22) (54) (11) (3) (19) (41) (12) (789) (1 019) Indirect expenses (464) (48) (238) (65) (24) (242) (245) (22) 1 348 -- Operating expenses - adjusted (4) (734) (110) (409) (119) (36) (358) (346) (91) (97) (2 300) Restructuring costs - direct (5) (3) (1) 2 -- (3) (190) -- (647) (847) - indirect (23) (2) 2 (1) (2) (148) (300) -- 474 -- Litigation and conduct costs -- -- -- -- -- (6) (101) -- (22) (129) Operating expenses (762) (115) (408) (118) (38) (515) (937) (91) (292) (3 276) Operating profit/(loss) before impairment (losses)/releases 551 49 392 42 49 (109) (848) 120 (339) (93) Impairment (losses)/releases (2) 54 (16) (4) 1 -- 50 (5) 1 79 Operating profit/(loss) 549 103 376 38 50 (109) (798) 115 (338) (14) Operating profit/(loss) - adjusted (3,4) 577 108 375 37 52 (30) (245) 115 (163) 826 Additional information Return on equity (5) 27,2% 16,7% 12,3% 7,4% 18,0% (6,4%) nm nm nm 9,0% Return on equity - adjusted (3,4,5) 28,7% 17,5% 12,3% 7,1% 18,8% (2,7%) nm nm nm 16,3% Cost:income ratio 58% 70% 51% 74% 44% 127% nm 43% nm 103% Cost:income ratio - adjusted (3,4) 56% 67% 51% 74% 41% 109% nm 43% nm 75% Total assets (£bn) 140,7 23,0 129,6 17,4 22,9 250,0 234,9 24,0 34,2 876,7 Funded assets (£bn) (6) 140,7 22,9 129,6 17,4 22,9 125,9 66,0 24,0 31,3 580,7 Net loans and advances to customers (£bn) 116,3 16,8 89,1 11,1 7,0 19,8 30,8 20,0 2,8 313,7 Risk elements in lending (£bn) 2,9 3,6 2,1 0,1 0,1 -- 5,3 0,5 -- 14,6 Impairment provisions (£bn) (2,0) (2,0) (0,7) -- (0,1) -- (4,0) (0,3) (0,2) (9,3) Customer deposits (£bn) 134,9 13,6 89,4 22,7 22,3 5,9 30,0 23,6 10,1 352,5 Risk-weighted assets (RWAs) (£bn) 33,3 19,6 64,2 8,4 8,1 38,8 59,7 10,1 73,8 316,0 RWA equivalent (£bn) (5) 36,0 19,8 70,1 8,4 8,1 39,5 62,0 10,7 74,1 328,7 Employee numbers (FTEs - thousands) 22,9 2,4 5,6 2,0 0,6 1,4 1,7 4,8 51,0 92,4 nm = not meaningful. For the notes to this table refer to page 23. RBS Group - Q4 2016 Financial Supplement Page 19

Financial Supplement Page 18 Page 20

Financial Supplement Page 18 Page 20