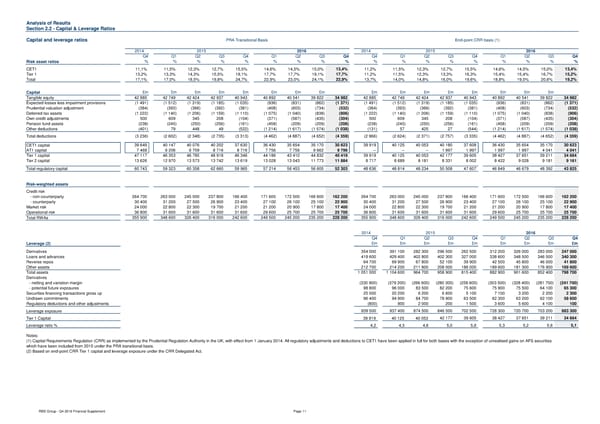

Analysis of Results Section 2.2 - Capital & Leverage Ratios Capital and leverage ratios PRA Transitional Basis End-point CRR basis (1) 2014 2015 2016 2014 2015 2016 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Risk asset ratios % % % % % % % % % % % % % % % % % % CET1 11,1% 11,5% 12,3% 12,7% 15,5% 14,6% 14,5% 15,0% 13,4% 11,2% 11,5% 12,3% 12,7% 15,5% 14,6% 14,5% 15,0% 13,4% Tier 1 13,2% 13,3% 14,3% 15,5% 19,1% 17,7% 17,7% 19,1% 17,7% 11,2% 11,5% 12,3% 13,3% 16,3% 15,4% 15,4% 16,7% 15,2% Total 17,1% 17,0% 18,5% 19,8% 24,7% 22,9% 23,0% 24,1% 22,9% 13,7% 14,0% 14,8% 16,0% 19,6% 18,8% 19,0% 20,6% 19,2% Capital £m £m £m £m £m £m £m £m £m £m £m £m £m £m £m £m Tangible equity 42 885 42 749 42 424 42 937 40 943 40 892 40 541 39 822 34 982 42 885 42 749 42 424 42 937 40 943 40 892 40 541 39 822 34 982 Expected losses less impairment provisions (1 491) (1 512) (1 319) (1 185) (1 035) (936) (831) (862) (1 371) (1 491) (1 512) (1 319) (1 185) (1 035) (936) (831) (862) (1 371) Prudential valuation adjustment (384) (393) (366) (392) (381) (408) (603) (734) (532) (384) (393) (366) (392) (381) (408) (603) (734) (532) Deferred tax assets (1 222) (1 140) (1 206) (1 159) (1 110) (1 075) (1 040) (838) (906) (1 222) (1 140) (1 206) (1 159) (1 110) (1 075) (1 040) (838) (906) Own credit adjustments 500 609 345 208 (104) (371) (587) (435) (304) 500 609 345 208 (104) (371) (587) (435) (304) Pension fund assets (238) (245) (250) (256) (161) (458) (209) (209) (208) (238) (245) (250) (256) (161) (458) (209) (209) (208) Other deductions (401) 79 448 49 (522) (1 214) (1 617) (1 574) (1 038) (131) 57 425 27 (544) (1 214) (1 617) (1 574) (1 038) Total deductions (3 236) (2 602) (2 348) (2 735) (3 313) (4 462) (4 887) (4 652) (4 359) (2 966) (2 624) (2 371) (2 757) (3 335) (4 462) (4 887) (4 652) (4 359) CET1 capital 39 649 40 147 40 076 40 202 37 630 36 430 35 654 35 170 30 623 39 919 40 125 40 053 40 180 37 608 36 430 35 654 35 170 30 623 AT1 capital 7 468 6 206 6 709 8 716 8 716 7 756 7 756 9 662 9 796 -- -- -- 1 997 1 997 1 997 1 997 4 041 4 041 Tier 1 capital 47 117 46 353 46 785 48 918 46 346 44 186 43 410 44 832 40 419 39 919 40 125 40 053 42 177 39 605 38 427 37 651 39 211 34 664 Tier 2 capital 13 626 12 970 13 573 13 742 13 619 13 028 13 043 11 773 11 884 8 717 8 689 8 181 8 331 8 002 8 422 9 028 9 181 9 161 Total regulatory capital 60 743 59 323 60 358 62 660 59 965 57 214 56 453 56 605 52 303 48 636 48 814 48 234 50 508 47 607 46 849 46 679 48 392 43 825 Risk-weighted assets Credit risk - non-counterparty 264 700 263 000 245 000 237 800 166 400 171 600 172 500 166 600 162 200 264 700 263 000 245 000 237 800 166 400 171 600 172 500 166 600 162 200 - counterparty 30 400 31 200 27 500 26 900 23 400 27 100 26 100 25 100 22 900 30 400 31 200 27 500 26 900 23 400 27 100 26 100 25 100 22 900 Market risk 24 000 22 800 22 300 19 700 21 200 21 200 20 900 17 800 17 400 24 000 22 800 22 300 19 700 21 200 21 200 20 900 17 800 17 400 Operational risk 36 800 31 600 31 600 31 600 31 600 29 600 25 700 25 700 25 700 36 800 31 600 31 600 31 600 31 600 29 600 25 700 25 700 25 700 Total RWAs 355 900 348 600 326 400 316 000 242 600 249 500 245 200 235 200 228 200 355 900 348 600 326 400 316 000 242 600 249 500 245 200 235 200 228 200 2014 2015 2016 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Leverage (2) £m £m £m £m £m £m £m £m £m Derivatives 354 000 391 100 282 300 296 500 262 500 312 200 326 000 283 000 247 000 Loans and advances 419 600 429 400 402 800 402 300 327 000 338 600 348 500 346 500 340 300 Reverse repos 64 700 69 900 67 800 52 100 39 900 42 500 45 800 46 000 41 800 Other assets 212 700 214 200 211 800 208 000 186 000 189 600 181 300 176 900 169 600 Total assets 1 051 000 1 104 600 964 700 958 900 815 400 882 900 901 600 852 400 798 700 Derivatives - netting and variation margin (330 900) (379 200) (266 600) (280 300) (258 600) (303 500) (328 400) (281 700) (241 700) - potential future exposures 98 800 96 000 83 500 82 200 75 600 75 900 75 500 64 100 65 300 Securities financing transactions gross up 25 000 20 200 6 200 6 600 5 100 7 100 3 200 2 200 2 300 Undrawn commitments 96 400 94 900 84 700 78 900 63 500 62 300 63 200 62 100 58 600 Regulatory deductions and other adjustments (800) 900 2 000 200 1 500 3 600 5 600 4 100 100 Leverage exposure 939 500 937 400 874 500 846 500 702 500 728 300 720 700 703 200 683 300 42 177 39 605 38 427 37 651 39 211 34 664 Tier 1 Capital 3 9 919 4 0 125 4 0 053 Leverage ratio % 4,2 4,3 4,6 5,0 5,6 5,3 5,2 5,6 5,1 Notes: (1) Capital Requirements Regulation (CRR) as implemented by the Prudential Regulation Authority in the UK, with effect from 1 January 2014. All regulatory adjustments and deductions to CET1 have been applied in full for both bases with the exception of unrealised gains on AFS securities which have been included from 2015 under the PRA transitional basis. (2) Based on end-point CRR Tier 1 capital and leverage exposure under the CRR Delegated Act. RBS Group - Q4 2016 Financial Supplement Page 11

Financial Supplement Page 10 Page 12

Financial Supplement Page 10 Page 12