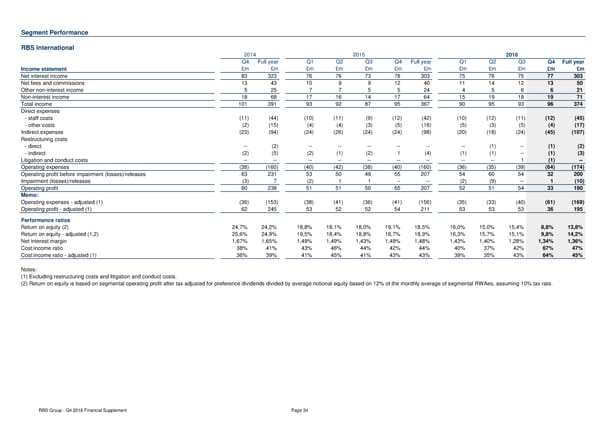

Segment Performance RBS International 2014 2015 2016 Q4 Full year Q1 Q2 Q3 Q4 Full year Q1 Q2 Q3 Q4 Full year Income statement £m £m £m £m £m £m £m £m £m £m £m £m Net interest income 83 323 76 76 73 78 303 75 76 75 77 303 Net fees and commissions 13 43 10 9 9 12 40 11 14 12 13 50 Other non-interest income 5 25 7 7 5 5 24 4 5 6 6 21 Non-interest income 18 68 17 16 14 17 64 15 19 18 19 71 Total income 101 391 93 92 87 95 367 90 95 93 96 374 Direct expenses - staff costs (11) (44) (10) (11) (9) (12) (42) (10) (12) (11) (12) (45) - other costs (2) (15) (4) (4) (3) (5) (16) (5) (3) (5) (4) (17) Indirect expenses (23) (94) (24) (26) (24) (24) (98) (20) (18) (24) (45) (107) Restructuring costs - direct -- (2) -- -- -- -- -- -- (1) -- (1) (2) - indirect (2) (5) (2) (1) (2) 1 (4) (1) (1) -- (1) (3) Litigation and conduct costs -- -- -- -- -- -- -- -- -- 1 (1) -- Operating expenses (38) (160) (40) (42) (38) (40) (160) (36) (35) (39) (64) (174) Operating profit before impairment (losses)/releases 63 231 53 50 49 55 207 54 60 54 32 200 Impairment (losses)/releases (3) 7 (2) 1 1 -- -- (2) (9) -- 1 (10) Operating profit 60 238 51 51 50 55 207 52 51 54 33 190 Memo: Operating expenses - adjusted (1) (36) (153) (38) (41) (36) (41) (156) (35) (33) (40) (61) (169) Operating profit - adjusted (1) 62 245 53 52 52 54 211 53 53 53 36 195 Performance ratios Return on equity (2) 24,7% 24,2% 18,8% 18,1% 18,0% 19,1% 18,5% 16,0% 15,0% 15,4% 8,8% 13,8% Return on equity - adjusted (1,2) 25,6% 24,9% 19,5% 18,4% 18,8% 18,7% 18,9% 16,3% 15,7% 15,1% 9,8% 14,2% Net interest margin 1,67% 1,65% 1,49% 1,49% 1,43% 1,49% 1,48% 1,43% 1,40% 1,28% 1,34% 1,36% Cost:income ratio 38% 41% 43% 46% 44% 42% 44% 40% 37% 42% 67% 47% Cost:income ratio - adjusted (1) 36% 39% 41% 45% 41% 43% 43% 39% 35% 43% 64% 45% Notes: (1) Excluding restructuring costs and litigation and conduct costs. (2) Return on equity is based on segmental operating profit after tax adjusted for preference dividends divided by average notional equity based on 12% of the monthly average of segmental RWAes, assuming 10% tax rate. RBS Group - Q4 2016 Financial Supplement Page 34

Financial Supplement Page 33 Page 35

Financial Supplement Page 33 Page 35