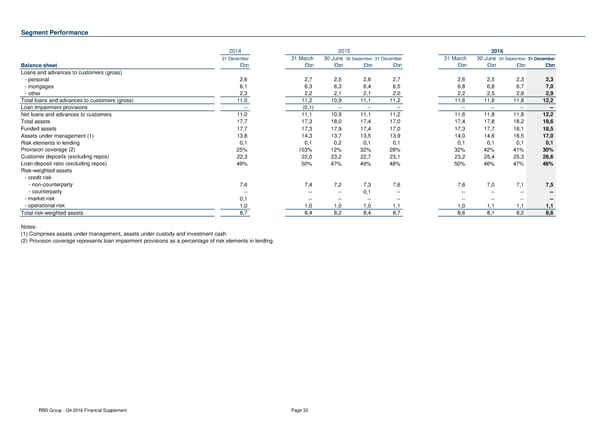

Segment Performance 2014 2015 2016 31 December 31 March 30 June 30 September 31 December 31 March 30 June 30 September 31 December Balance sheet £bn £bn £bn £bn £bn £bn £bn £bn £bn Loans and advances to customers (gross) - personal 2,6 2,7 2,5 2,6 2,7 2,6 2,5 2,3 2,3 - mortgages 6,1 6,3 6,3 6,4 6,5 6,8 6,8 6,7 7,0 - other 2,3 2,2 2,1 2,1 2,0 2,2 2,5 2,8 2,9 Total loans and advances to customers (gross) 11,0 11,2 10,9 11,1 11,2 11,6 11,8 11,8 12,2 Loan Impairment provisions -- (0,1) -- -- -- -- -- -- -- Net loans and advances to customers 11,0 11,1 10,9 11,1 11,2 11,6 11,8 11,8 12,2 Total assets 17,7 17,3 18,0 17,4 17,0 17,4 17,8 18,2 18,6 Funded assets 17,7 17,3 17,9 17,4 17,0 17,3 17,7 18,1 18,5 Assets under management (1) 13,8 14,3 13,7 13,5 13,9 14,0 14,6 16,5 17,0 Risk elements in lending 0,1 0,1 0,2 0,1 0,1 0,1 0,1 0,1 0,1 Provision coverage (2) 25% 103% 12% 32% 28% 32% 42% 41% 30% Customer deposits (excluding repos) 22,3 22,0 23,2 22,7 23,1 23,2 25,4 25,3 26,6 Loan:deposit ratio (excluding repos) 49% 50% 47% 49% 48% 50% 46% 47% 46% Risk-weighted assets - credit risk - non-counterparty 7,6 7,4 7,2 7,3 7,6 7,6 7,0 7,1 7,5 - counterparty -- -- -- 0,1 -- -- -- -- -- - market risk 0,1 -- -- -- -- -- -- -- -- - operational risk 1,0 1,0 1,0 1,0 1,1 1,0 1,1 1,1 1,1 Total risk-weighted assets 8,7 8,4 8,2 8,4 8,7 8,6 8,1 8,2 8,6 Notes: (1) Comprises assets under management, assets under custody and investment cash. (2) Provision coverage represents loan impairment provisions as a percentage of risk elements in lending. RBS Group - Q4 2016 Financial Supplement Page 33

Financial Supplement Page 32 Page 34

Financial Supplement Page 32 Page 34