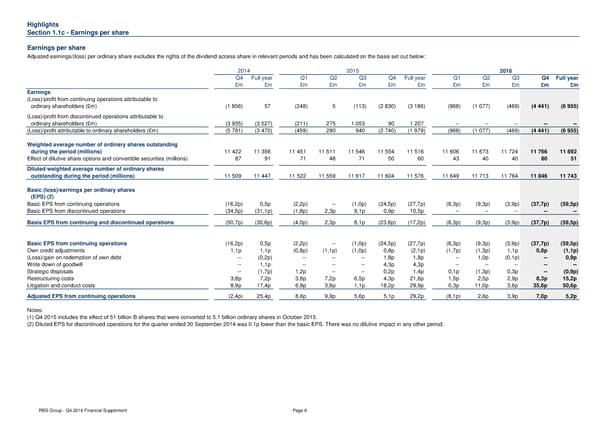

Highlights Section 1.1c - Earnings per share Earnings per share Adjusted earnings/(loss) per ordinary share excludes the rights of the dividend access share in relevant periods and has been calculated on the basis set out below: 2014 2015 2016 Q4 Full year Q1 Q2 Q3 Q4 Full year Q1 Q2 Q3 Q4 Full year £m £m £m £m £m £m £m £m £m £m £m £m Earnings (Loss)/profit from continuing operations attributable to ordinary shareholders (£m) (1 856) 57 (248) 5 (113) (2 830) (3 186) (968) (1 077) (469) (4 441) (6 955) (Loss)/profit from discontinued operations attributable to ordinary shareholders (£m) (3 935) (3 527) (211) 275 1 053 90 1 207 -- -- -- -- -- (Loss)/profit attributable to ordinary shareholders (£m) (5 791) (3 470) (459) 280 940 (2 740) (1 979) (968) (1 077) (469) (4 441) (6 955) Weighted average number of ordinary shares outstanding during the period (millions) 11 422 11 356 11 451 11 511 11 546 11 554 11 516 11 606 11 673 11 724 11 766 11 692 Effect of dilutive share options and convertible securities (millions) 87 91 71 48 71 50 60 43 40 40 80 51 Diluted weighted average number of ordinary shares outstanding during the period (millions) 11 509 11 447 11 522 11 559 11 617 11 604 11 576 11 649 11 713 11 764 11 846 11 743 Basic (loss)/earnings per ordinary shares (EPS) (2) Basic EPS from continuing operations (16,2p) 0,5p (2,2p) -- (1,0p) (24,5p) (27,7p) (8,3p) (9,3p) (3,9p) (37,7p) (59,5p) Basic EPS from discontinued operations (34,5p) (31,1p) (1,8p) 2,3p 9,1p 0,9p 10,5p -- -- -- -- -- Basis EPS from continuing and discontinued operations (50,7p) (30,6p) (4,0p) 2,3p 8,1p (23,6p) (17,2p) (8,3p) (9,3p) (3,9p) (37,7p) (59,5p) Basic EPS from continuing operations (16,2p) 0,5p (2,2p) -- (1,0p) (24,5p) (27,7p) (8,3p) (9,3p) (3,9p) (37,7p) (59,5p) Own credit adjustments 1,1p 1,1p (0,8p) (1,1p) (1,0p) 0,8p (2,1p) (1,7p) (1,3p) 1,1p 0,8p (1,1p) (Loss)/gain on redemption of own debt -- (0,2p) -- -- -- 1,8p 1,8p -- 1,0p (0,1p) -- 0,9p Write down of goodwill -- 1,1p -- -- -- 4,3p 4,3p -- -- -- -- -- Strategic disposals -- (1,7p) 1,2p -- -- 0,2p 1,4p 0,1p (1,3p) 0,3p -- (0,9p) Restructuring costs 3,8p 7,2p 3,6p 7,2p 6,5p 4,3p 21,6p 1,5p 2,5p 2,9p 8,3p 15,2p Litigation and conduct costs 8,9p 17,4p 6,8p 3,8p 1,1p 18,2p 29,9p 0,3p 11,0p 3,6p 35,6p 50,6p Adjusted EPS from continuing operations (2,4p) 25,4p 8,6p 9,9p 5,6p 5,1p 29,2p (8,1p) 2,6p 3,9p 7,0p 5,2p Notes: (1) Q4 2015 includes the effect of 51 billion B shares that were converted to 5.1 billion ordinary shares in October 2015. (2) Diluted EPS for discontinued operations for the quarter ended 30 September 2014 was 0.1p lower than the basic EPS. There was no dilutive impact in any other period. RBS Group - Q4 2016 Financial Supplement Page 6

Financial Supplement Page 5 Page 7

Financial Supplement Page 5 Page 7