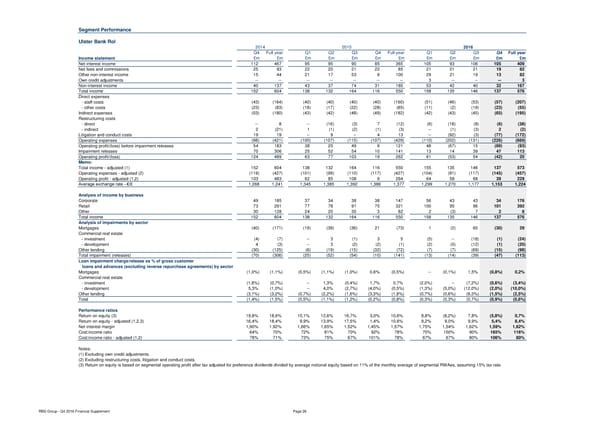

Segment Performance Ulster Bank RoI 2014 2015 2016 Q4 Full year Q1 Q2 Q3 Q4 Full year Q1 Q2 Q3 Q4 Full year Income statement £m £m £m £m £m £m £m £m £m £m £m £m Net interest income 112 467 95 95 90 85 365 105 93 106 105 409 Net fees and commissions 25 93 22 20 21 22 85 21 21 21 19 82 Other non-interest income 15 44 21 17 53 9 100 29 21 19 13 82 Own credit adjustments -- -- -- -- -- -- -- 3 -- -- -- 3 Non-interest income 40 137 43 37 74 31 185 53 42 40 32 167 Total income 152 604 138 132 164 116 550 158 135 146 137 576 Direct expenses - staff costs (43) (164) (40) (40) (40) (40) (160) (51) (46) (53) (57) (207) - other costs (23) (83) (18) (17) (22) (28) (85) (11) (2) (19) (23) (55) Indirect expenses (53) (180) (43) (42) (48) (49) (182) (42) (43) (45) (65) (195) Restructuring costs - direct -- 8 -- (16) (3) 7 (12) (6) (18) (8) (6) (38) - indirect 2 (21) 1 (1) (2) (1) (3) -- (1) (3) 2 (2) Litigation and conduct costs 19 19 -- 9 -- 4 13 -- (92) (3) (77) (172) Operating expenses (98) (421) (100) (107) (115) (107) (429) (110) (202) (131) (226) (669) Operating profit/(loss) before impairment releases 54 183 38 25 49 9 121 48 (67) 15 (89) (93) Impairment releases 70 306 25 52 54 10 141 13 14 39 47 113 Operating profit/(loss) 124 489 63 77 103 19 262 61 (53) 54 (42) 20 Memo: Total income - adjusted (1) 152 604 138 132 164 116 550 155 135 146 137 573 Operating expenses - adjusted (2) (119) (427) (101) (99) (110) (117) (427) (104) (91) (117) (145) (457) Operating profit - adjusted (1,2) 103 483 62 85 108 9 264 64 58 68 39 229 Average exchange rate - €/£ 1,268 1,241 1,345 1,385 1,392 1,386 1,377 1,299 1,270 1,177 1,153 1,224 Analysis of income by business Corporate 49 185 37 34 38 38 147 56 43 43 34 176 Retail 73 291 77 78 91 75 321 100 95 96 101 392 Other 30 128 24 20 35 3 82 2 (3) 7 2 8 Total income 152 604 138 132 164 116 550 158 135 146 137 576 Analysis of impairments by sector Mortgages (40) (171) (19) (39) (36) 21 (73) 1 (2) 60 (30) 29 Commercial real estate - investment (4) (7) -- 3 (1) 3 5 (5) -- (18) (1) (24) - development 4 (3) -- 3 (2) (2) (1) (2) (5) (12) (1) (20) Other lending (30) (125) (6) (19) (15) (32) (72) (7) (7) (69) (15) (98) Total impairment (releases) (70) (306) (25) (52) (54) (10) (141) (13) (14) (39) (47) (113) Loan impairment charge/release as % of gross customer loans and advances (excluding reverse repurchase agreements) by sector Mortgages (1,0%) (1,1%) (0,5%) (1,1%) (1,0%) 0,6% (0,5%) -- (0,1%) 1,5% (0,8%) 0,2% Commercial real estate - investment (1,6%) (0,7%) -- 1,3% (0,4%) 1,7% 0,7% (2,0%) -- (7,2%) (0,6%) (3,4%) - development 5,3% (1,0%) -- 4,0% (2,7%) (4,0%) (0,5%) (1,3%) (5,0%) (12,0%) (2,0%) (10,0%) Other lending (3,1%) (3,2%) (0,7%) (2,2%) (1,6%) (3,3%) (1,8%) (0,7%) (0,6%) (6,3%) (1,5%) (2,5%) Total (1,4%) (1,5%) (0,5%) (1,1%) (1,2%) (0,2%) (0,8%) (0,3%) (0,3%) (0,7%) (0,9%) (0,6%) Performance ratios Return on equity (3) 19,8% 18,6% 10,1% 12,6% 16,7% 3,0% 10,6% 8,8% (8,2%) 7,8% (5,8%) 0,7% Return on equity - adjusted (1,2,3) 16,4% 18,4% 9,9% 13,9% 17,5% 1,4% 10,6% 9,2% 9,0% 9,9% 5,4% 8,4% Net interest margin 1,90% 1,92% 1,66% 1,65% 1,52% 1,45% 1,57% 1,75% 1,54% 1,62% 1,59% 1,62% Cost:income ratio 64% 70% 72% 81% 70% 92% 78% 70% 150% 90% 165% 116% Cost:income ratio - adjusted (1,2) 78% 71% 73% 75% 67% 101% 78% 67% 67% 80% 106% 80% Notes: (1) Excluding own credit adjustments. (2) Excluding restructuring costs, litigation and conduct costs. (3) Return on equity is based on segmental operating profit after tax adjusted for preference dividends divided by average notional equity based on 11% of the monthly average of segmental RWAes, assuming 15% tax rate. RBS Group - Q4 2016 Financial Supplement Page 26

Financial Supplement Page 25 Page 27

Financial Supplement Page 25 Page 27