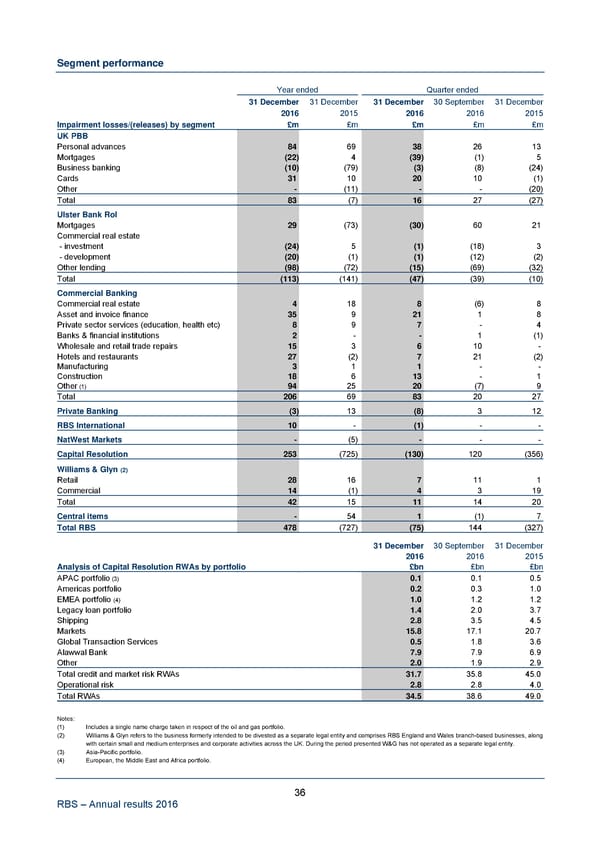

Segment performance Year ended Quarter ended 31 December 31 December 31 December 30 September 31 December 2016 2015 2016 2016 2015 Impairment losses/(releases) by segment £m £m £m £m £m UK PBB Personal advances 84 69 38 26 13 Mortgages (22) 4 (39) (1) 5 Business banking (10) (79) (3) (8) (24) Cards 31 10 20 10 (1) Other - (11) - - (20) Total 83 (7) 16 27 (27) Ulster Bank RoI Mortgages 29 (73) (30) 60 21 Commercial real estate - investment (24) 5 (1) (18) 3 - development (20) (1) (1) (12) (2) Other lending (98) (72) (15) (69) (32) Total (113) (141) (47) (39) (10) Commercial Banking Commercial real estate 4 18 8 (6) 8 Asset and invoice finance 35 9 21 1 8 Private sector services (education, health etc) 8 9 7 - 4 Banks & financial institutions 2 - - 1 (1) Wholesale and retail trade repairs 15 3 6 10 - Hotels and restaurants 27 (2) 7 21 (2) Manufacturing 3 1 1 - - Construction 18 6 13 - 1 Other (1) 94 25 20 (7) 9 Total 206 69 83 20 27 Private Banking (3) 13 (8) 3 12 RBS International 10 - (1) - - NatWest Markets - (5) - - - Capital Resolution 253 (725) (130) 120 (356) Williams & Glyn (2) Retail 28 16 7 11 1 Commercial 14 (1) 4 3 19 Total 42 15 11 14 20 Central items - 54 1 (1) 7 Total RBS 478 (727) (75) 144 (327) 31 December 30 September 31 December 2016 2016 2015 Analysis of Capital Resolution RWAs by portfolio £bn £bn £bn APAC portfolio (3) 0.1 0.1 0.5 Americas portfolio 0.2 0.3 1.0 EMEA portfolio (4) 1.0 1.2 1.2 Legacy loan portfolio 1.4 2.0 3.7 Shipping 2.8 3.5 4.5 Markets 15.8 17.1 20.7 Global Transaction Services 0.5 1.8 3.6 Alawwal Bank 7.9 7.9 6.9 Other 2.0 1.9 2.9 Total credit and market risk RWAs 31.7 35.8 45.0 Operational risk 2.8 2.8 4.0 Total RWAs 34.5 38.6 49.0 Notes: (1) Includes a single name charge taken in respect of the oil and gas portfolio. (2) Williams & Glyn refers to the business formerly intended to be divested as a separate legal entity and comprises RBS England and Wales branch-based businesses, along with certain small and medium enterprises and corporate activities across the UK. During the period presented W&G has not operated as a separate legal entity. (3) Asia-Pacific portfolio. (4) European, the Middle East and Africa portfolio. 36 RBS – Annual results 2016

Annual Results Announcement Page 41 Page 43

Annual Results Announcement Page 41 Page 43