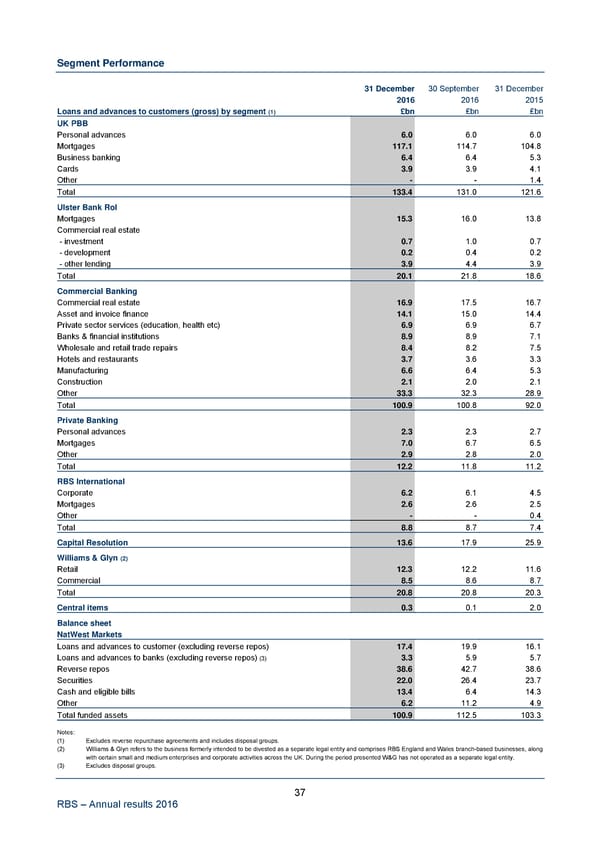

Segment Performance 31 December 30 September 31 December 2016 2016 2015 Loans and advances to customers (gross) by segment (1) £bn £bn £bn UK PBB Personal advances 6.0 6.0 6.0 Mortgages 117.1 114.7 104.8 Business banking 6.4 6.4 5.3 Cards 3.9 3.9 4.1 Other - - 1.4 Total 133.4 131.0 121.6 Ulster Bank RoI Mortgages 15.3 16.0 13.8 Commercial real estate - investment 0.7 1.0 0.7 - development 0.2 0.4 0.2 - other lending 3.9 4.4 3.9 Total 20.1 21.8 18.6 Commercial Banking Commercial real estate 16.9 17.5 16.7 Asset and invoice finance 14.1 15.0 14.4 Private sector services (education, health etc) 6.9 6.9 6.7 Banks & financial institutions 8.9 8.9 7.1 Wholesale and retail trade repairs 8.4 8.2 7.5 Hotels and restaurants 3.7 3.6 3.3 Manufacturing 6.6 6.4 5.3 Construction 2.1 2.0 2.1 Other 33.3 32.3 28.9 Total 100.9 100.8 92.0 Private Banking Personal advances 2.3 2.3 2.7 Mortgages 7.0 6.7 6.5 Other 2.9 2.8 2.0 Total 12.2 11.8 11.2 RBS International Corporate 6.2 6.1 4.5 Mortgages 2.6 2.6 2.5 Other - - 0.4 Total 8.8 8.7 7.4 Capital Resolution 13.6 17.9 25.9 Williams & Glyn (2) Retail 12.3 12.2 11.6 Commercial 8.5 8.6 8.7 Total 20.8 20.8 20.3 Central items 0.3 0.1 2.0 Balance sheet NatWest Markets Loans and advances to customer (excluding reverse repos) 17.4 19.9 16.1 Loans and advances to banks (excluding reverse repos) (3) 3.3 5.9 5.7 Reverse repos 38.6 42.7 38.6 Securities 22.0 26.4 23.7 Cash and eligible bills 13.4 6.4 14.3 Other 6.2 11.2 4.9 Total funded assets 100.9 112.5 103.3 Notes: (1) Excludes reverse repurchase agreements and includes disposal groups. (2) Williams & Glyn refers to the business formerly intended to be divested as a separate legal entity and comprises RBS England and Wales branch-based businesses, along with certain small and medium enterprises and corporate activities across the UK. During the period presented W&G has not operated as a separate legal entity. (3) Excludes disposal groups. 37 RBS – Annual results 2016

Annual Results Announcement Page 42 Page 44

Annual Results Announcement Page 42 Page 44