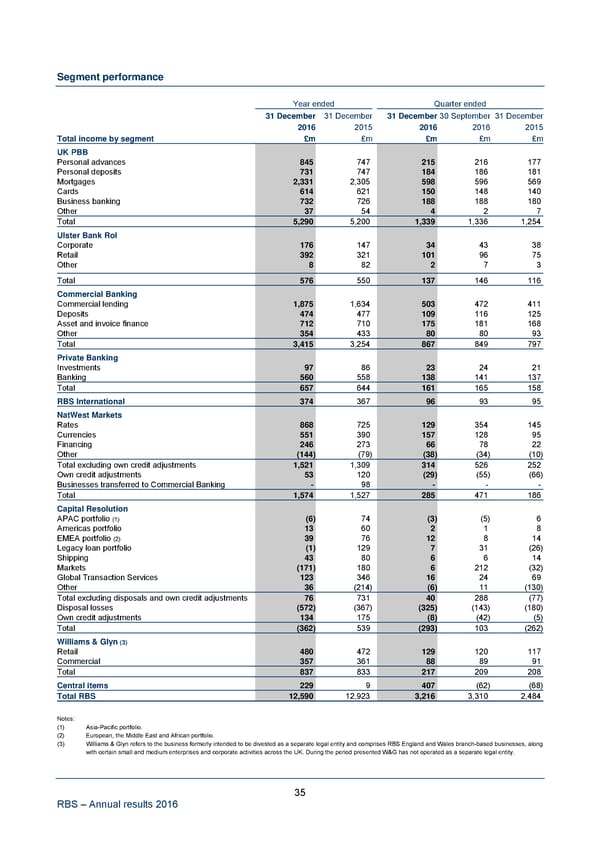

Segment performance Year ended Quarter ended 31 December 31 December 31 December 30 September 31 December 2016 2015 2016 2016 2015 Total income by segment £m £m £m £m £m UK PBB Personal advances 845 747 215 216 177 Personal deposits 731 747 184 186 181 Mortgages 2,331 2,305 598 596 569 Cards 614 621 150 148 140 Business banking 732 726 188 188 180 Other 37 54 4 2 7 Total 5,290 5,200 1,339 1,336 1,254 Ulster Bank RoI Corporate 176 147 34 43 38 Retail 392 321 101 96 75 Other 8 82 2 7 3 Total 576 550 137 146 116 Commercial Banking Commercial lending 1,875 1,634 503 472 411 Deposits 474 477 109 116 125 Asset and invoice finance 712 710 175 181 168 Other 354 433 80 80 93 Total 3,415 3,254 867 849 797 Private Banking Investments 97 86 23 24 21 Banking 560 558 138 141 137 Total 657 644 161 165 158 RBS International 374 367 96 93 95 NatWest Markets Rates 868 725 129 354 145 Currencies 551 390 157 128 95 Financing 246 273 66 78 22 Other (144) (79) (38) (34) (10) Total excluding own credit adjustments 1,521 1,309 314 526 252 Own credit adjustments 53 120 (29) (55) (66) Businesses transferred to Commercial Banking - 98 - - - Total 1,574 1,527 285 471 186 Capital Resolution APAC portfolio (1) (6) 74 (3) (5) 6 Americas portfolio 13 60 2 1 8 EMEA portfolio (2) 39 76 12 8 14 Legacy loan portfolio (1) 129 7 31 (26) Shipping 43 80 6 6 14 Markets (171) 180 6 212 (32) Global Transaction Services 123 346 16 24 69 Other 36 (214) (6) 11 (130) Total excluding disposals and own credit adjustments 76 731 40 288 (77) Disposal losses (572) (367) (325) (143) (180) Own credit adjustments 134 175 (8) (42) (5) Total (362) 539 (293) 103 (262) Williams & Glyn (3) Retail 480 472 129 120 117 Commercial 357 361 88 89 91 Total 837 833 217 209 208 Central items 229 9 407 (62) (68) Total RBS 12,590 12,923 3,216 3,310 2,484 Notes: (1) Asia-Pacific portfolio. (2) European, the Middle East and African portfolio. (3) Williams & Glyn refers to the business formerly intended to be divested as a separate legal entity and comprises RBS England and Wales branch-based businesses, along with certain small and medium enterprises and corporate activities across the UK. During the period presented W&G has not operated as a separate legal entity. 35 RBS – Annual results 2016

Annual Results Announcement Page 40 Page 42

Annual Results Announcement Page 40 Page 42