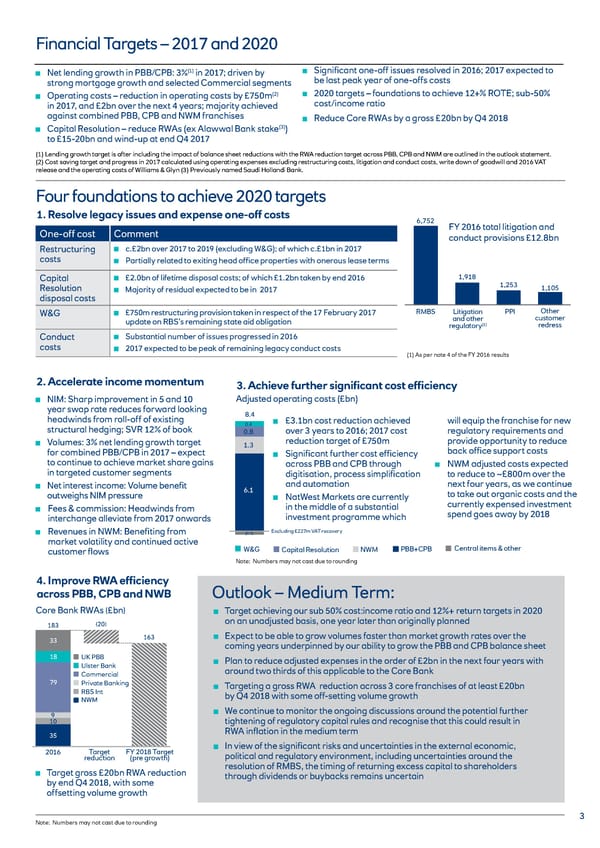

Financial Targets – 2017 and 2020 Net lending growth in PBB/CPB: 3%(1) in 2017; driven by S ignificant one-off issues resolved in 2016; 2017 expected to strong mortgage growth and selected Commercial segments be last peak year of one-offs costs Operating costs – reduction in operating costs by £750m(2) 2 020 targets – foundations to achieve 12+% ROTE; sub-50% in 2017, and £2bn over the next 4 years; majority achieved cost/income ratio against combined PBB, CPB and NWM franchises R educe Core RWAs by a gross £20bn by Q4 2018 Capital Resolution – reduce RWAs (ex Alawwal Bank stake(3)) to £15-20bn and wind-up at end Q4 2017 (1) Lending growth target is after including the impact of balance sheet reductions with the RWA reduction target across PBB, CPB and NWM are outlined in the outlook statement. (2) Cost saving target and progress in 2017 calculated using operating expenses excluding restructuring costs, litigation and conduct costs, write down of goodwill and 2016 VAT release and the operating costs of Williams & Glyn (3) Previously named Saudi Hollandi Bank. Four foundations to achieve 2020 targets 1. Resolve legacy issues and expense one-off costs 6,752 One-off cost Comment FY 2016 total litigation and conduct provisions £12.8bn Restructuring c.£2bn over 2017 to 2019 (excluding W&G); of which c.£1bn in 2017 costs Partially related to exiting head office properties with onerous lease terms Capital £2.0bn of lifetime disposal costs; of which £1.2bn taken by end 2016 1,918 Resolution M ajority of residual expected to be in 2017 1,253 1,105 disposal costs W&G £750m restructuring provision taken in respect of the 17 February 2017 RMBS Litigation PPI Other update on RBS’s remaining state aid obligation and other customer regulatory(1) redress Conduct Substantial number of issues progressed in 2016 costs 2017 expected to be peak of remaining legacy conduct costs (1) As per note 4 of the FY 2016 results 2. Accelerate income momentum 3. Achieve further significant cost efficiency NIM: Sharp improvement in 5 and 10 Adjusted operating costs (£bn) year swap rate reduces forward looking 8.4 headwinds from roll-off of existing 0.4 £3.1bn cost reduction achieved will equip the franchise for new structural hedging; SVR 12% of book 0.8 over 3 years to 2016; 2017 cost regulatory requirements and Volumes: 3% net lending growth target 1.3 reduction target of £750m provide opportunity to reduce for combined PBB/CPB in 2017 – expect Significant further cost efficiency back office support costs to continue to achieve market share gains across PBB and CPB through NWM adjusted costs expected in targeted customer segments digitisation, process simplification to reduce to ~£800m over the Net interest income: Volume benefit 6.1 and automation next four years, as we continue outweighs NIM pressure NatWest Markets are currently to take out organic costs and the Fees & commission: Headwinds from in the middle of a substantial currently expensed investment interchange alleviate from 2017 onwards investment programme which spend goes away by 2018 Revenues in NWM: Benefiting from (0.1) Excluding £227m VAT recovery market volatility and continued active Central items & other customer flows W&G Capital Resolution NWM PBB+CPB Note: Numbers may not cast due to rounding 4. Improve RWA efficiency across PBB, CPB and NWB Outlook – Medium Term: ( ) Core Bank RWAs £bn Target achieving our sub 50% cost:income ratio and 12%+ return targets in 2020 183 (20) on an unadjusted basis, one year later than originally planned 33 163 Expect to be able to grow volumes faster than market growth rates over the coming years underpinned by our ability to grow the PBB and CPB balance sheet 18 UK PBB Plan to reduce adjusted expenses in the order of £2bn in the next four years with Ulster Bank around two thirds of this applicable to the Core Bank Commercial 79 Private Banking Targeting a gross RWA reduction across 3 core franchises of at least £20bn RBS Int by Q4 2018 with some off-setting volume growth NWM 9 We continue to monitor the ongoing discussions around the potential further 10 tightening of regulatory capital rules and recognise that this could result in 35 RWA inflation in the medium term 2016 Target FY 2018 Target In view of the significant risks and uncertainties in the external economic, reduction (pre growth) political and regulatory environment, including uncertainties around the Target gross £20bn RWA reduction resolution of RMBS, the timing of returning excess capital to shareholders by end Q4 2018, with some through dividends or buybacks remains uncertain offsetting volume growth Note: Numbers may not cast due to rounding 3

Investor Factbook Page 2 Page 4

Investor Factbook Page 2 Page 4