Investor Factbook

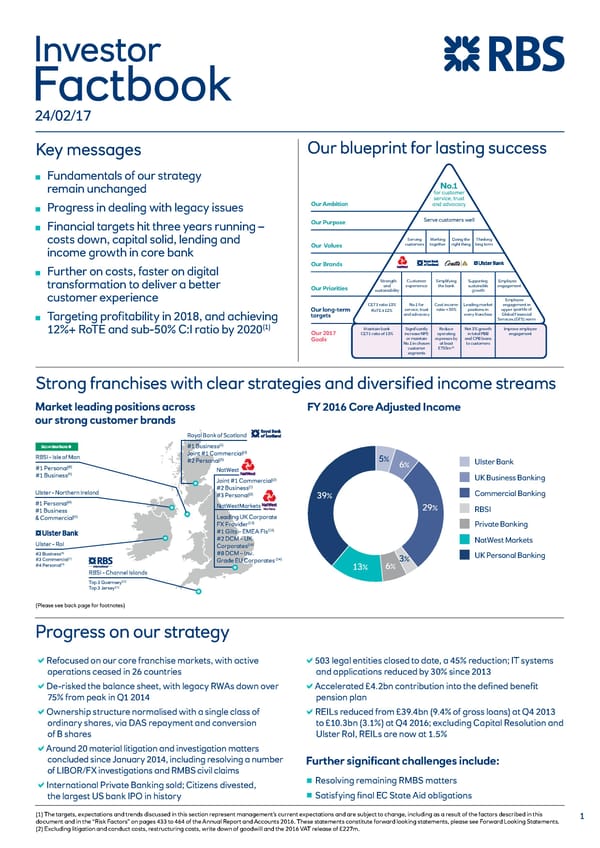

Investor Factbook 22 Feb 2017 24/02/17 Version 15 Key messages Our blueprint for lasting success Fundamentals of our strategy remain unchanged No.1 for customer service, trust Progress in dealing with legacy issues Our Ambition and advocacy Financial targets hit three years running – Our Purpose Serve customers well costs down, capital solid, lending and Serving Working Doing the Thinking income growth in core bank Our Values customers together right thing long term Further on costs, faster on digital Our Brands Strength Customer Simplifying Supporting Employee transformation to deliver a better Our Priorities and experience the bank sustainable engagement sustainability growth customer experience Employee CET1 ratio 13% No.1 for Cost:income Leading market engagement in Our long-term ≥ service, trust ratio <50% positions in upper quartile of RoTE 12% Targeting profitability in 2018, and achieving targets and advocacy every franchise Global Financial Services (GFS) norm 12%+ RoTE and sub-50% C:I ratio by 2020(1) Maintain bank Significantly Reduce Net 3% growth Improve employee Our 2017 CET1 ratio of 13% increase NPS operating in total PBB engagement Goals or maintain expenses by and CPB loans No.1 in chosen at least to customers customer £750m(2) segments Strong franchises with clear strategies and diversified income streams Market leading positions across FY 2016 Core Adjusted Income our strong customer brands Royal Bank of Scotland #1 Business(1) Joint #1 Commercial(2) RBSI - Isle of Man #2 Personal(3) 5% 6% Ulster Bank (8) #1 Personal NatWest #1 Business(9) UK Business Banking Joint #1 Commercial(2) #2 Business(1) Ulster - Northern Ireland (3) Commercial Banking #3 Personal 39% (4) #1 Personal NatWestMarkets 29% RBSI #1 Business & Commercial(5) Leading UK Corporate FX Provider(12) Private Banking #1 Gilts – EMEA FIs(13) #2 DCM – UK NatWest Markets Ulster - RoI (14) Corporates #3 Business(6) #8 DCM – Inv. UK Personal Banking #3 Commercial(7) (14) 3% Grade EU Corporates (4) #4 Personal 13% 6% RBSI - Channel Islands Top 3 Guernsey(10) Top 3 Jersey(11) (Please see back page for footnotes) Progress on our strategy aRefocused on our core franchise markets, with active a503 legal entities closed to date, a 45% reduction; IT systems operations ceased in 26 countries and applications reduced by 30% since 2013 aDe-risked the balance sheet, with legacy RWAs down over aAccelerated £4.2bn contribution into the defined benefit 75% from peak in Q1 2014 pension plan aOwnership structure normalised with a single class of aREILs reduced from £39.4bn (9.4% of gross loans) at Q4 2013 ordinary shares, via DAS repayment and conversion to £10.3bn (3.1%) at Q4 2016; excluding Capital Resolution and of B shares Ulster RoI, REILs are now at 1.5% aAround 20 material litigation and investigation matters concluded since January 2014, including resolving a number Further significant challenges include: of LIBOR/FX investigations and RMBS civil claims a International Private Banking sold; Citizens divested, Resolving remaining RMBS matters the largest US bank IPO in history Satisfying final EC State Aid obligations (1) The targets, expectations and trends discussed in this section represent management’s current expectations and are subject to change, including as a result of the factors described in this 1 document and in the “Risk Factors” on pages 433 to 464 of the Annual Report and Accounts 2016. These statements constitute forward looking statements, please see Forward Looking Statements. (2) Excluding litigation and conduct costs, restructuring costs, write down of goodwill and the 2016 VAT release of £227m.

Investor Factbook Page 2

Investor Factbook Page 2