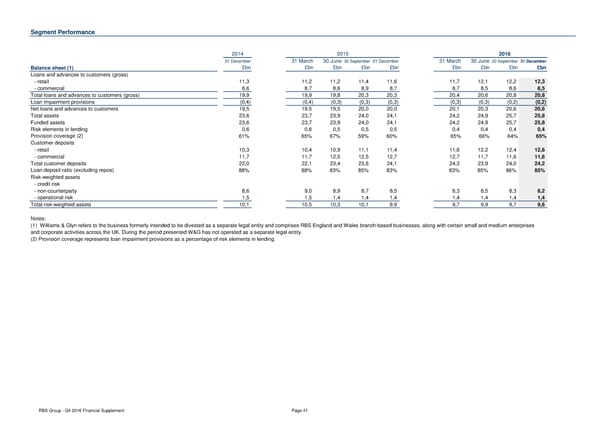

Segment Performance 2014 2015 2016 31 December 31 March 30 June 30 September 31 December 31 March 30 June 30 September 31 December Balance sheet (1) £bn £bn £bn £bn £bn £bn £bn £bn £bn Loans and advances to customers (gross) - retail 11,3 11,2 11,2 11,4 11,6 11,7 12,1 12,2 12,3 - commercial 8,6 8,7 8,6 8,9 8,7 8,7 8,5 8,6 8,5 Total loans and advances to customers (gross) 19,9 19,9 19,8 20,3 20,3 20,4 20,6 20,8 20,8 Loan impairment provisions (0,4) (0,4) (0,3) (0,3) (0,3) (0,3) (0,3) (0,2) (0,2) Net loans and advances to customers 19,5 19,5 19,5 20,0 20,0 20,1 20,3 20,6 20,6 Total assets 23,6 23,7 23,9 24,0 24,1 24,2 24,9 25,7 25,8 Funded assets 23,6 23,7 23,9 24,0 24,1 24,2 24,9 25,7 25,8 Risk elements in lending 0,6 0,6 0,5 0,5 0,5 0,4 0,4 0,4 0,4 Provision coverage (2) 61% 65% 67% 59% 60% 65% 66% 64% 65% Customer deposits - retail 10,3 10,4 10,9 11,1 11,4 11,6 12,2 12,4 12,6 - commercial 11,7 11,7 12,5 12,5 12,7 12,7 11,7 11,6 11,6 Total customer deposits 22,0 22,1 23,4 23,6 24,1 24,3 23,9 24,0 24,2 Loan:deposit ratio (excluding repos) 88% 88% 83% 85% 83% 83% 85% 86% 85% Risk-weighted assets - credit risk - non-counterparty 8,6 9,0 8,9 8,7 8,5 8,3 8,5 8,3 8,2 - operational risk 1,5 1,5 1,4 1,4 1,4 1,4 1,4 1,4 1,4 Total risk-weighted assets 10,1 10,5 10,3 10,1 9,9 9,7 9,9 9,7 9,6 Notes: (1) Williams & Glyn refers to the business formerly intended to be divested as a separate legal entity and comprises RBS England and Wales branch-based businesses, along with certain small and medium enterprises and corporate activities across the UK. During the period presented W&G has not operated as a separate legal entity. (2) Provision coverage represents loan impairment provisions as a percentage of risk elements in lending. RBS Group - Q4 2016 Financial Supplement Page 41

Financial Supplement Page 40 Page 42

Financial Supplement Page 40 Page 42