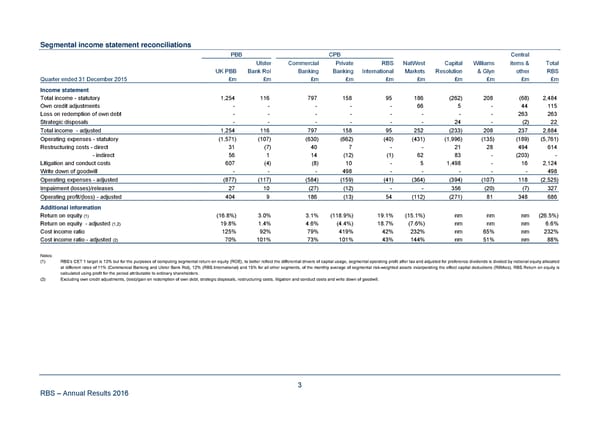

Segmental income statement reconciliations PBB CPB Central Ulster Commercial Private RBS NatWest Capital Williams items & Total UK PBB Bank RoI Banking Banking International Markets Resolution & Glyn other RBS Quarter ended 31 December 2015 £m £m £m £m £m £m £m £m £m £m Income statement Total income - statutory 1,254 116 797 158 95 186 (262) 208 (68) 2,484 Own credit adjustments - - - - - 66 5 - 44 115 Loss on redemption of own debt - - - - - - - - 263 263 Strategic disposals - - - - - - 24 - (2) 22 Total income - adjusted 1,254 116 797 158 95 252 (233) 208 237 2,884 Operating expenses - statutory (1,571) (107) (630) (662) (40) (431) (1,996) (135) (189) (5,761) Restructuring costs - direct 31 (7) 40 7 - - 21 28 494 614 - indirect 56 1 14 (12) (1) 62 83 - (203) - Litigation and conduct costs 607 (4) (8) 10 - 5 1,498 - 16 2,124 Write down of goodwill - - - 498 - - - - - 498 Operating expenses - adjusted (877) (117) (584) (159) (41) (364) (394) (107) 118 (2,525) Impairment (losses)/releases 27 10 (27) (12) - - 356 (20) (7) 327 Operating profit/(loss) - adjusted 404 9 186 (13) 54 (112) (271) 81 348 686 Additional information Return on equity (1) (16.8%) 3.0% 3.1% (118.9%) 19.1% (15.1%) nm nm nm (26.5%) Return on equity - adjusted (1,2) 19.8% 1.4% 4.6% (4.4%) 18.7% (7.6%) nm nm nm 6.6% Cost income ratio 125% 92% 79% 419% 42% 232% nm 65% nm 232% Cost income ratio - adjusted (2) 70% 101% 73% 101% 43% 144% nm 51% nm 88% Notes: (1) RBS’s CET 1 target is 13% but for the purposes of computing segmental return on equity (ROE), to better reflect the differential drivers of capital usage, segmental operating profit after tax and adjusted for preference dividends is divided by notional equity allocated at different rates of 11% (Commercial Banking and Ulster Bank RoI), 12% (RBS International) and 15% for all other segments, of the monthly average of segmental risk-weighted assets incorporating the effect capital deductions (RWAes). RBS Return on equity is calculated using profit for the period attributable to ordinary shareholders. (2) Excluding own credit adjustments, (loss)/gain on redemption of own debt, strategic disposals, restructuring costs, litigation and conduct costs and write down of goodwill. RBS – Annual Results 2016 3

Annual Results Announcement Page 78

Annual Results Announcement Page 78