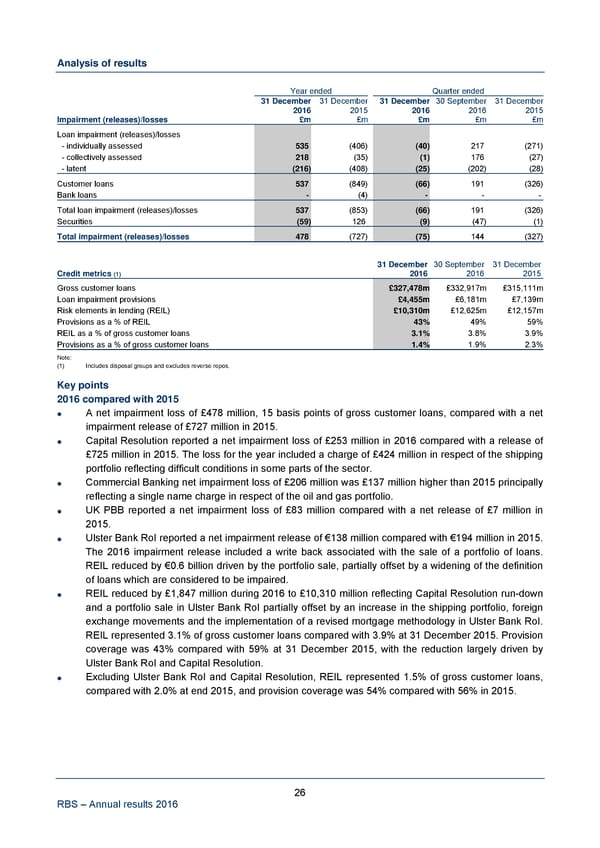

Analysis of results Year ended Quarter ended 31 December 31 December 31 December 30 September 31 December 2016 2015 2016 2016 2015 Impairment (releases)/losses £m £m £m £m £m Loan impairment (releases)/losses - individually assessed 535 (406) (40) 217 (271) - collectively assessed 218 (35) (1) 176 (27) - latent (216) (408) (25) (202) (28) Customer loans 537 (849) (66) 191 (326) Bank loans - (4) - - - Total loan impairment (releases)/losses 537 (853) (66) 191 (326) Securities (59) 126 (9) (47) (1) Total impairment (releases)/losses 478 (727) (75) 144 (327) 31 December 30 September 31 December Credit metrics (1) 2016 2016 2015 Gross customer loans £327,478m £332,917m £315,111m Loan impairment provisions £4,455m £6,181m £7,139m Risk elements in lending (REIL) £10,310m £12,625m £12,157m Provisions as a % of REIL 43% 49% 59% REIL as a % of gross customer loans 3.1% 3.8% 3.9% Provisions as a % of gross customer loans 1.4% 1.9% 2.3% Note: (1) Includes disposal groups and excludes reverse repos. Key points 2016 compared with 2015 A net impairment loss of £478 million, 15 basis points of gross customer loans, compared with a net impairment release of £727 million in 2015. Capital Resolution reported a net impairment loss of £253 million in 2016 compared with a release of £725 million in 2015. The loss for the year included a charge of £424 million in respect of the shipping portfolio reflecting difficult conditions in some parts of the sector. Commercial Banking net impairment loss of £206 million was £137 million higher than 2015 principally reflecting a single name charge in respect of the oil and gas portfolio. UK PBB reported a net impairment loss of £83 million compared with a net release of £7 million in 2015. Ulster Bank RoI reported a net impairment release of €138 million compared with €194 million in 2015. The 2016 impairment release included a write back associated with the sale of a portfolio of loans. REIL reduced by €0.6 billion driven by the portfolio sale, partially offset by a widening of the definition of loans which are considered to be impaired. REIL reduced by £1,847 million during 2016 to £10,310 million reflecting Capital Resolution run-down and a portfolio sale in Ulster Bank RoI partially offset by an increase in the shipping portfolio, foreign exchange movements and the implementation of a revised mortgage methodology in Ulster Bank RoI. REIL represented 3.1% of gross customer loans compared with 3.9% at 31 December 2015. Provision coverage was 43% compared with 59% at 31 December 2015, with the reduction largely driven by Ulster Bank RoI and Capital Resolution. Excluding Ulster Bank RoI and Capital Resolution, REIL represented 1.5% of gross customer loans, compared with 2.0% at end 2015, and provision coverage was 54% compared with 56% in 2015. 26 RBS – Annual results 2016

Annual Results Announcement Page 30 Page 32

Annual Results Announcement Page 30 Page 32