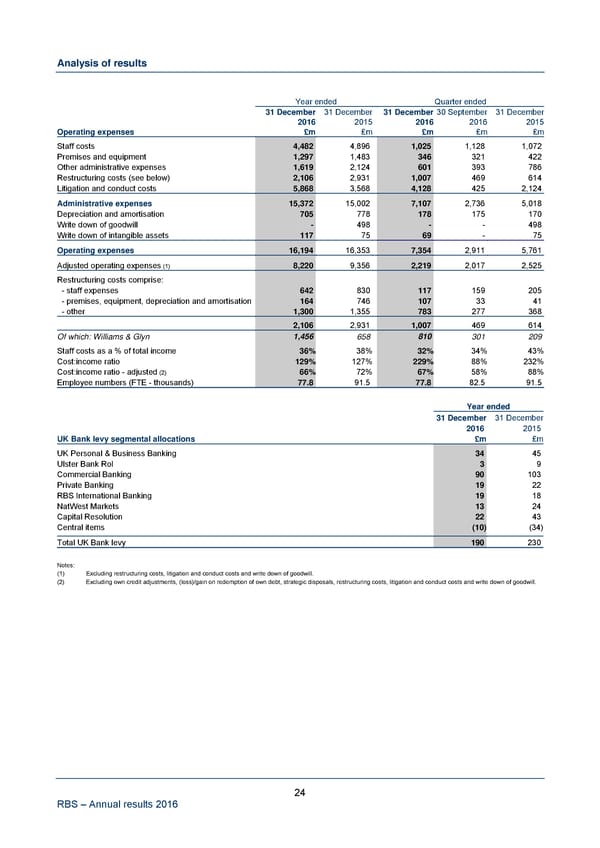

Analysis of results Year ended Quarter ended 31 December 31 December 31 December 30 September 31 December 2016 2015 2016 2016 2015 Operating expenses £m £m £m £m £m Staff costs 4,482 4,896 1,025 1,128 1,072 Premises and equipment 1,297 1,483 346 321 422 Other administrative expenses 1,619 2,124 601 393 786 Restructuring costs (see below) 2,106 2,931 1,007 469 614 Litigation and conduct costs 5,868 3,568 4,128 425 2,124 Administrative expenses 15,372 15,002 7,107 2,736 5,018 Depreciation and amortisation 705 778 178 175 170 Write down of goodwill - 498 - - 498 Write down of intangible assets 117 75 69 - 75 Operating expenses 16,194 16,353 7,354 2,911 5,761 Adjusted operating expenses (1) 8,220 9,356 2,219 2,017 2,525 Restructuring costs comprise: - staff expenses 642 830 117 159 205 - premises, equipment, depreciation and amortisation 164 746 107 33 41 - other 1,300 1,355 783 277 368 2,106 2,931 1,007 469 614 Of which: Williams & Glyn 1,456 658 810 301 209 Staff costs as a % of total income 36% 38% 32% 34% 43% Cost:income ratio 129% 127% 229% 88% 232% Cost:income ratio - adjusted (2) 66% 72% 67% 58% 88% Employee numbers (FTE - thousands) 77.8 91.5 77.8 82.5 91.5 Year ended 31 December 31 December 2016 2015 UK Bank levy segmental allocations £m £m UK Personal & Business Banking 34 45 Ulster Bank RoI 3 9 Commercial Banking 90 103 Private Banking 19 22 RBS International Banking 19 18 NatWest Markets 13 24 Capital Resolution 22 43 Central items (10) (34) Total UK Bank levy 190 230 Notes: (1) Excluding restructuring costs, litigation and conduct costs and write down of goodwill. (2) Excluding own credit adjustments, (loss)/gain on redemption of own debt, strategic disposals, restructuring costs, litigation and conduct costs and write down of goodwill. 24 RBS – Annual results 2016

Annual Results Announcement Page 28 Page 30

Annual Results Announcement Page 28 Page 30