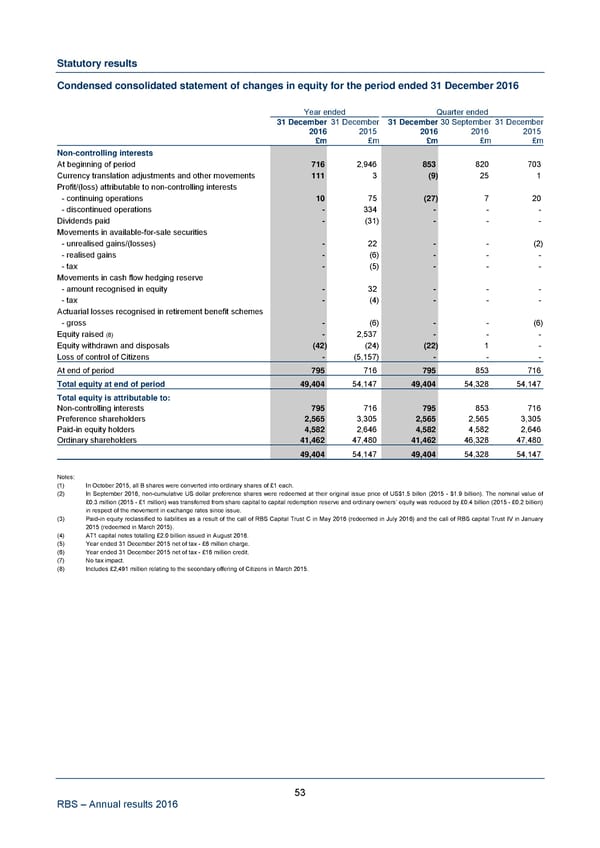

Statutory results Condensed consolidated statement of changes in equity for the period ended 31 December 2016 Year ended Quarter ended 31 December 31 December 31 December 30 September 31 December 2016 2015 2016 2016 2015 £m £m £m £m £m Non-controlling interests At beginning of period 716 2,946 853 820 703 Currency translation adjustments and other movements 111 3 (9) 25 1 Profit/(loss) attributable to non-controlling interests - continuing operations 10 75 (27) 7 20 - discontinued operations - 334 - - - Dividends paid - (31) - - - Movements in available-for-sale securities - unrealised gains/(losses) - 22 - - (2) - realised gains - (6) - - - - tax - (5) - - - Movements in cash flow hedging reserve - amount recognised in equity - 32 - - - - tax - (4) - - - Actuarial losses recognised in retirement benefit schemes - gross - (6) - - (6) Equity raised (8) - 2,537 - - - Equity withdrawn and disposals (42) (24) (22) 1 - Loss of control of Citizens - (5,157) - - - At end of period 795 716 795 853 716 Total equity at end of period 49,404 54,147 49,404 54,328 54,147 Total equity is attributable to: Non-controlling interests 795 716 795 853 716 Preference shareholders 2,565 3,305 2,565 2,565 3,305 Paid-in equity holders 4,582 2,646 4,582 4,582 2,646 Ordinary shareholders 41,462 47,480 41,462 46,328 47,480 49,404 54,147 49,404 54,328 54,147 Notes: (1) In October 2015, all B shares were converted into ordinary shares of £1 each. (2) In September 2016, non-cumulative US dollar preference shares were redeemed at their original issue price of US$1.5 billon (2015 - $1.9 billion). The nominal value of £0.3 million (2015 - £1 million) was transferred from share capital to capital redemption reserve and ordinary owners’ equity was reduced by £0.4 billion (2015 - £0.2 billion) in respect of the movement in exchange rates since issue. (3) Paid-in equity reclassified to liabilities as a result of the call of RBS Capital Trust C in May 2016 (redeemed in July 2016) and the call of RBS capital Trust IV in January 2015 (redeemed in March 2015). (4) AT1 capital notes totalling £2.0 billion issued in August 2016. (5) Year ended 31 December 2015 net of tax - £6 million charge. (6) Year ended 31 December 2015 net of tax - £16 million credit. (7) No tax impact. (8) Includes £2,491 million relating to the secondary offering of Citizens in March 2015. 53 RBS – Annual results 2016

Annual Results Announcement Page 59 Page 61

Annual Results Announcement Page 59 Page 61