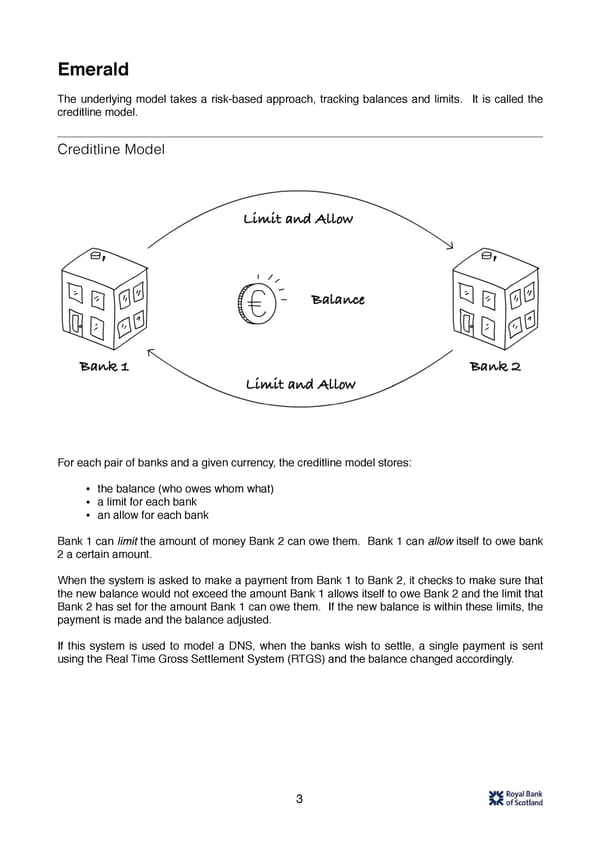

Emerald The underlying model takes a risk-based approach, tracking balances and limits. It is called the creditline model. Creditline Model For each pair of banks and a given currency, the creditline model stores: • the balance (who owes whom what) • a limit for each bank • an allow for each bank Bank 1 can limit the amount of money Bank 2 can owe them. Bank 1 can allow itself to owe bank 2 a certain amount. When the system is asked to make a payment from Bank 1 to Bank 2, it checks to make sure that the new balance would not exceed the amount Bank 1 allows itself to owe Bank 2 and the limit that Bank 2 has set for the amount Bank 1 can owe them. If the new balance is within these limits, the payment is made and the balance adjusted. If this system is used to model a DNS, when the banks wish to settle, a single payment is sent using the Real Time Gross Settlement System (RTGS) and the balance changed accordingly. 3

Proving Ethereum for the Clearing Use Case Page 3 Page 5

Proving Ethereum for the Clearing Use Case Page 3 Page 5