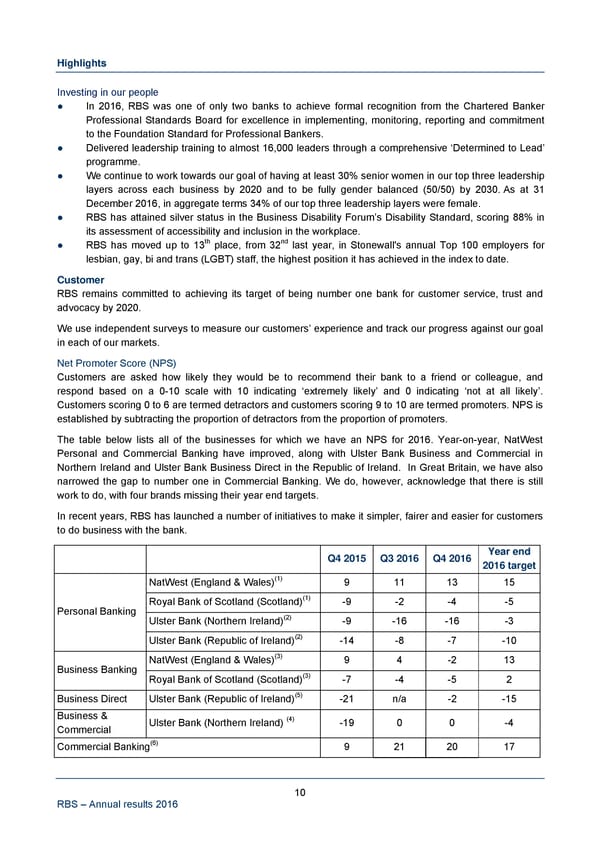

Highlights Investing in our people ● In 2016, RBS was one of only two banks to achieve formal recognition from the Chartered Banker Professional Standards Board for excellence in implementing, monitoring, reporting and commitment to the Foundation Standard for Professional Bankers. ● Delivered leadership training to almost 16,000 leaders through a comprehensive ‘Determined to Lead’ programme. ● We continue to work towards our goal of having at least 30% senior women in our top three leadership layers across each business by 2020 and to be fully gender balanced (50/50) by 2030. As at 31 December 2016, in aggregate terms 34% of our top three leadership layers were female. ● RBS has attained silver status in the Business Disability Forum’s Disability Standard, scoring 88% in its assessment of accessibility and inclusion in the workplace. th nd ● RBS has moved up to 13 place, from 32 last year, in Stonewall's annual Top 100 employers for lesbian, gay, bi and trans (LGBT) staff, the highest position it has achieved in the index to date. Customer RBS remains committed to achieving its target of being number one bank for customer service, trust and advocacy by 2020. We use independent surveys to measure our customers’ experience and track our progress against our goal in each of our markets. Net Promoter Score (NPS) Customers are asked how likely they would be to recommend their bank to a friend or colleague, and respond based on a 0-10 scale with 10 indicating ‘extremely likely’ and 0 indicating ‘not at all likely’. Customers scoring 0 to 6 are termed detractors and customers scoring 9 to 10 are termed promoters. NPS is established by subtracting the proportion of detractors from the proportion of promoters. The table below lists all of the businesses for which we have an NPS for 2016. Year-on-year, NatWest Personal and Commercial Banking have improved, along with Ulster Bank Business and Commercial in Northern Ireland and Ulster Bank Business Direct in the Republic of Ireland. In Great Britain, we have also narrowed the gap to number one in Commercial Banking. We do, however, acknowledge that there is still work to do, with four brands missing their year end targets. In recent years, RBS has launched a number of initiatives to make it simpler, fairer and easier for customers to do business with the bank. Q4 2015 Q3 2016 Q4 2016 Year end 2016 target (1) NatWest (England & Wales) 9 11 13 15 (1) Personal Banking Royal Bank of Scotland (Scotland) -9 -2 -4 -5 (2) Ulster Bank (Northern Ireland) -9 -16 -16 -3 Ulster Bank (Republic of Ireland)(2) -14 -8 -7 -10 (3) Business Banking NatWest (England & Wales) 9 4 -2 13 (3) Royal Bank of Scotland (Scotland) -7 -4 -5 2 Business Direct Ulster Bank (Republic of Ireland)(5) -21 n/a -2 -15 Business & Ulster Bank (Northern Ireland) (4) -19 0 0 -4 Commercial Commercial Banking(6) 9 21 20 17 10 RBS – Annual results 2016

Annual Results Announcement Page 11 Page 13

Annual Results Announcement Page 11 Page 13