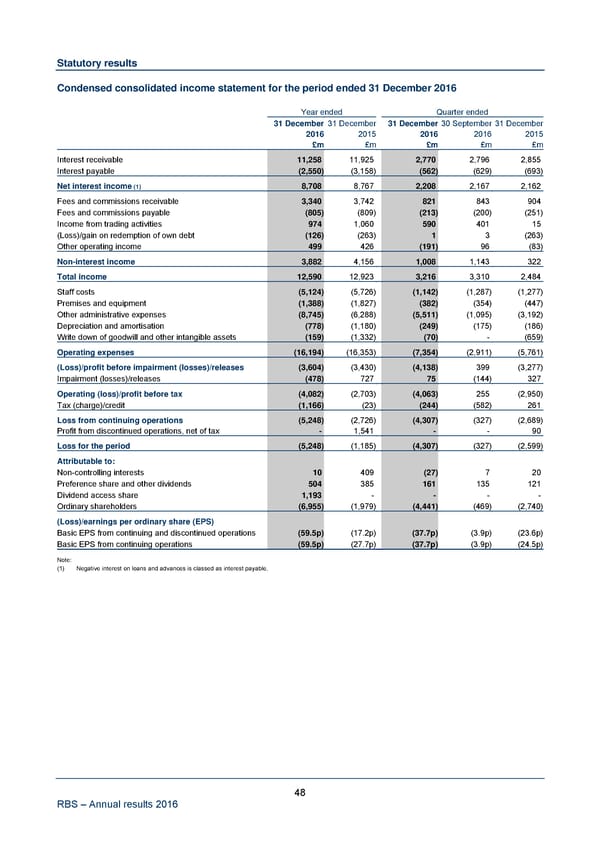

Statutory results Condensed consolidated income statement for the period ended 31 December 2016 Year ended Quarter ended 31 December 31 December 31 December 30 September 31 December 2016 2015 2016 2016 2015 £m £m £m £m £m Interest receivable 11,258 11,925 2,770 2,796 2,855 Interest payable (2,550) (3,158) (562) (629) (693) Net interest income (1) 8,708 8,767 2,208 2,167 2,162 Fees and commissions receivable 3,340 3,742 821 843 904 Fees and commissions payable (805) (809) (213) (200) (251) Income from trading activities 974 1,060 590 401 15 (Loss)/gain on redemption of own debt (126) (263) 1 3 (263) Other operating income 499 426 (191) 96 (83) Non-interest income 3,882 4,156 1,008 1,143 322 Total income 12,590 12,923 3,216 3,310 2,484 Staff costs (5,124) (5,726) (1,142) (1,287) (1,277) Premises and equipment (1,388) (1,827) (382) (354) (447) Other administrative expenses (8,745) (6,288) (5,511) (1,095) (3,192) Depreciation and amortisation (778) (1,180) (249) (175) (186) Write down of goodwill and other intangible assets (159) (1,332) (70) - (659) Operating expenses (16,194) (16,353) (7,354) (2,911) (5,761) (Loss)/profit before impairment (losses)/releases (3,604) (3,430) (4,138) 399 (3,277) Impairment (losses)/releases (478) 727 75 (144) 327 Operating (loss)/profit before tax (4,082) (2,703) (4,063) 255 (2,950) Tax (charge)/credit (1,166) (23) (244) (582) 261 Loss from continuing operations (5,248) (2,726) (4,307) (327) (2,689) Profit from discontinued operations, net of tax - 1,541 - - 90 Loss for the period (5,248) (1,185) (4,307) (327) (2,599) Attributable to: Non-controlling interests 10 409 (27) 7 20 Preference share and other dividends 504 385 161 135 121 Dividend access share 1,193 - - - - Ordinary shareholders (6,955) (1,979) (4,441) (469) (2,740) (Loss)/earnings per ordinary share (EPS) Basic EPS from continuing and discontinued operations (59.5p) (17.2p) (37.7p) (3.9p) (23.6p) Basic EPS from continuing operations (59.5p) (27.7p) (37.7p) (3.9p) (24.5p) Note: (1) Negative interest on loans and advances is classed as interest payable. 48 RBS – Annual results 2016

Annual Results Announcement Page 54 Page 56

Annual Results Announcement Page 54 Page 56