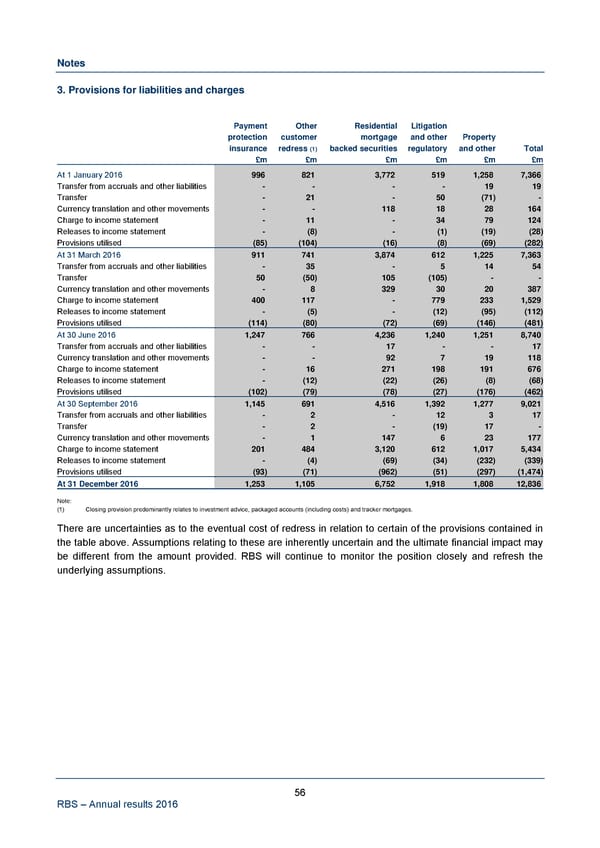

Notes 3. Provisions for liabilities and charges Payment Other Residential Litigation protection customer mortgage and other Property insurance redress (1) backed securities regulatory and other Total £m £m £m £m £m £m At 1 January 2016 996 821 3,772 519 1,258 7,366 Transfer from accruals and other liabilities - - - - 19 19 Transfer - 21 - 50 (71) - Currency translation and other movements - - 118 18 28 164 Charge to income statement - 11 - 34 79 124 Releases to income statement - (8) - (1) (19) (28) Provisions utilised (85) (104) (16) (8) (69) (282) At 31 March 2016 911 741 3,874 612 1,225 7,363 Transfer from accruals and other liabilities - 35 - 5 14 54 Transfer 50 (50) 105 (105) - - Currency translation and other movements - 8 329 30 20 387 Charge to income statement 400 117 - 779 233 1,529 Releases to income statement - (5) - (12) (95) (112) Provisions utilised (114) (80) (72) (69) (146) (481) At 30 June 2016 1,247 766 4,236 1,240 1,251 8,740 Transfer from accruals and other liabilities - - 17 - - 17 Currency translation and other movements - - 92 7 19 118 Charge to income statement - 16 271 198 191 676 Releases to income statement - (12) (22) (26) (8) (68) Provisions utilised (102) (79) (78) (27) (176) (462) At 30 September 2016 1,145 691 4,516 1,392 1,277 9,021 Transfer from accruals and other liabilities - 2 - 12 3 17 Transfer - 2 - (19) 17 - Currency translation and other movements - 1 147 6 23 177 Charge to income statement 201 484 3,120 612 1,017 5,434 Releases to income statement - (4) (69) (34) (232) (339) Provisions utilised (93) (71) (962) (51) (297) (1,474) At 31 December 2016 1,253 1,105 6,752 1,918 1,808 12,836 Note: (1) Closing provision predominantly relates to investment advice, packaged accounts (including costs) and tracker mortgages. There are uncertainties as to the eventual cost of redress in relation to certain of the provisions contained in the table above. Assumptions relating to these are inherently uncertain and the ultimate financial impact may be different from the amount provided. RBS will continue to monitor the position closely and refresh the underlying assumptions. 56 RBS – Annual results 2016

Annual Results Announcement Page 63 Page 65

Annual Results Announcement Page 63 Page 65