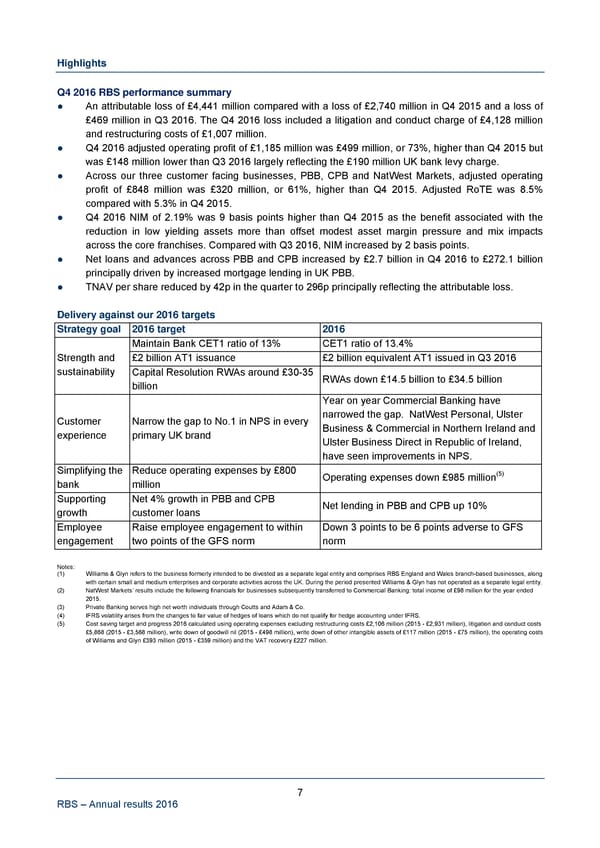

Highlights Q4 2016 RBS performance summary ● An attributable loss of £4,441 million compared with a loss of £2,740 million in Q4 2015 and a loss of £469 million in Q3 2016. The Q4 2016 loss included a litigation and conduct charge of £4,128 million and restructuring costs of £1,007 million. ● Q4 2016 adjusted operating profit of £1,185 million was £499 million, or 73%, higher than Q4 2015 but was £148 million lower than Q3 2016 largely reflecting the £190 million UK bank levy charge. ● Across our three customer facing businesses, PBB, CPB and NatWest Markets, adjusted operating profit of £848 million was £320 million, or 61%, higher than Q4 2015. Adjusted RoTE was 8.5% compared with 5.3% in Q4 2015. ● Q4 2016 NIM of 2.19% was 9 basis points higher than Q4 2015 as the benefit associated with the reduction in low yielding assets more than offset modest asset margin pressure and mix impacts across the core franchises. Compared with Q3 2016, NIM increased by 2 basis points. ● Net loans and advances across PBB and CPB increased by £2.7 billion in Q4 2016 to £272.1 billion principally driven by increased mortgage lending in UK PBB. ● TNAV per share reduced by 42p in the quarter to 296p principally reflecting the attributable loss. Delivery against our 2016 targets Strategy goal 2016 target 2016 Maintain Bank CET1 ratio of 13% CET1 ratio of 13.4% Strength and £2 billion AT1 issuance £2 billion equivalent AT1 issued in Q3 2016 sustainability Capital Resolution RWAs around £30-35 RWAs down £14.5 billion to £34.5 billion billion Year on year Commercial Banking have Customer Narrow the gap to No.1 in NPS in every narrowed the gap. NatWest Personal, Ulster experience primary UK brand Business & Commercial in Northern Ireland and Ulster Business Direct in Republic of Ireland, have seen improvements in NPS. Simplifying the Reduce operating expenses by £800 (5) bank million Operating expenses down £985 million Supporting Net 4% growth in PBB and CPB Net lending in PBB and CPB up 10% growth customer loans Employee Raise employee engagement to within Down 3 points to be 6 points adverse to GFS engagement two points of the GFS norm norm Notes: (1) Williams & Glyn refers to the business formerly intended to be divested as a separate legal entity and comprises RBS England and Wales branch-based businesses, along with certain small and medium enterprises and corporate activities across the UK. During the period presented Williams & Glyn has not operated as a separate legal entity. (2) NatWest Markets’ results include the following financials for businesses subsequently transferred to Commercial Banking: total income of £98 million for the year ended 2015. (3) Private Banking serves high net worth individuals through Coutts and Adam & Co. (4) IFRS volatility arises from the changes to fair value of hedges of loans which do not qualify for hedge accounting under IFRS. (5) Cost saving target and progress 2016 calculated using operating expenses excluding restructuring costs £2,106 million (2015 - £2,931 million), litigation and conduct costs £5,868 (2015 - £3,568 million), write down of goodwill nil (2015 - £498 million), write down of other intangible assets of £117 million (2015 - £75 million), the operating costs of Williams and Glyn £393 million (2015 - £359 million) and the VAT recovery £227 million. 7 RBS – Annual results 2016

Annual Results Announcement Page 8 Page 10

Annual Results Announcement Page 8 Page 10