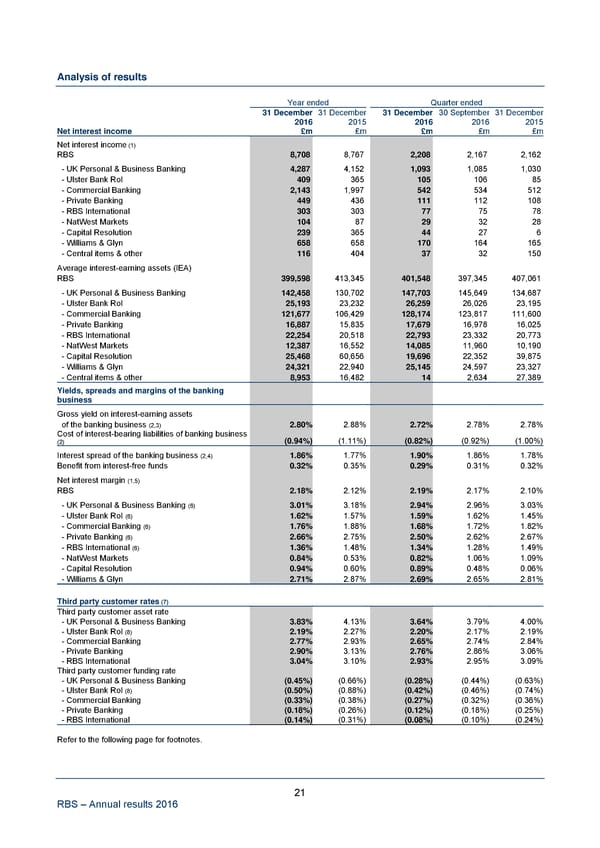

Analysis of results Year ended Quarter ended 31 December 31 December 31 December 30 September 31 December 2016 2015 2016 2016 2015 Net interest income £m £m £m £m £m Net interest income (1) RBS 8,708 8,767 2,208 2,167 2,162 - UK Personal & Business Banking 4,287 4,152 1,093 1,085 1,030 - Ulster Bank RoI 409 365 105 106 85 - Commercial Banking 2,143 1,997 542 534 512 - Private Banking 449 436 111 112 108 - RBS International 303 303 77 75 78 - NatWest Markets 104 87 29 32 28 - Capital Resolution 239 365 44 27 6 - Williams & Glyn 658 658 170 164 165 - Central items & other 116 404 37 32 150 Average interest-earning assets (IEA) RBS 399,598 413,345 401,548 397,345 407,061 - UK Personal & Business Banking 142,458 130,702 147,703 145,649 134,687 - Ulster Bank RoI 25,193 23,232 26,259 26,026 23,195 - Commercial Banking 121,677 106,429 128,174 123,817 111,600 - Private Banking 16,887 15,835 17,679 16,978 16,025 - RBS International 22,254 20,518 22,793 23,332 20,773 - NatWest Markets 12,387 16,552 14,085 11,960 10,190 - Capital Resolution 25,468 60,656 19,696 22,352 39,875 - Williams & Glyn 24,321 22,940 25,145 24,597 23,327 - Central items & other 8,953 16,482 14 2,634 27,389 Yields, spreads and margins of the banking business Gross yield on interest-earning assets of the banking business (2,3) 2.80% 2.88% 2.72% 2.78% 2.78% Cost of interest-bearing liabilities of banking business (0.94%) (1.11%) (0.82%) (0.92%) (1.00%) (2) Interest spread of the banking business (2,4) 1.86% 1.77% 1.90% 1.86% 1.78% Benefit from interest-free funds 0.32% 0.35% 0.29% 0.31% 0.32% Net interest margin (1,5) RBS 2.18% 2.12% 2.19% 2.17% 2.10% - UK Personal & Business Banking (6) 3.01% 3.18% 2.94% 2.96% 3.03% - Ulster Bank RoI (6) 1.62% 1.57% 1.59% 1.62% 1.45% - Commercial Banking (6) 1.76% 1.88% 1.68% 1.72% 1.82% - Private Banking (6) 2.66% 2.75% 2.50% 2.62% 2.67% - RBS International (6) 1.36% 1.48% 1.34% 1.28% 1.49% - NatWest Markets 0.84% 0.53% 0.82% 1.06% 1.09% - Capital Resolution 0.94% 0.60% 0.89% 0.48% 0.06% - Williams & Glyn 2.71% 2.87% 2.69% 2.65% 2.81% Third party customer rates (7) Third party customer asset rate - UK Personal & Business Banking 3.83% 4.13% 3.64% 3.79% 4.00% - Ulster Bank RoI (8) 2.19% 2.27% 2.20% 2.17% 2.19% - Commercial Banking 2.77% 2.93% 2.65% 2.74% 2.84% - Private Banking 2.90% 3.13% 2.76% 2.86% 3.06% - RBS International 3.04% 3.10% 2.93% 2.95% 3.09% Third party customer funding rate - UK Personal & Business Banking (0.45%) (0.66%) (0.28%) (0.44%) (0.63%) - Ulster Bank RoI (8) (0.50%) (0.88%) (0.42%) (0.46%) (0.74%) - Commercial Banking (0.33%) (0.38%) (0.27%) (0.32%) (0.36%) - Private Banking (0.18%) (0.26%) (0.12%) (0.18%) (0.25%) - RBS International (0.14%) (0.31%) (0.08%) (0.10%) (0.24%) Refer to the following page for footnotes. 21 RBS – Annual results 2016

Annual Results Announcement Page 25 Page 27

Annual Results Announcement Page 25 Page 27